3 New Loan Apps in 2025 Offering Instant Loans Without CIBIL Score or Income Proof

In 2025, access to quick and hassle-free loans has become more inclusive, thanks to innovative fintech solutions. For individuals with no CIBIL score or income proof, securing a loan can be challenging through traditional lenders. However, new loan apps are emerging to bridge this gap, offering small, short-term loans without requiring credit checks or extensive documentation. In this article, we explore three such apps—Score Climb Credit Growth, Creditrack Loan App, and Smart Finance Loan App—that provide instant loans in 2025, focusing on their features, benefits, and considerations.

1. Score Climb Credit Growth: Build Credit with Small, Short-Term Loans

Score Climb Credit Growth is a unique 7-day loan app designed for individuals seeking quick cash while aiming to improve their credit profile. This app caters to users who may not have a CIBIL score or income proof, making it an accessible option for first-time borrowers or those with limited credit history.

Key Features:

- Loan Amount: Offers small loans, typically around ₹1,500.

- Disbursal After Fees: After processing fees and taxes, users may receive approximately ₹900 in their bank account.

- Repayment Tenure: Loans must be repaid within 7 days.

- Credit Score Growth: Timely repayments are reported to credit bureaus, helping users build or improve their credit score over time.

- Minimal Documentation: Requires only basic KYC documents like Aadhaar and PAN, with no need for income proof or CIBIL score.

Benefits:

- Ideal for emergencies requiring small amounts.

- Helps users establish a credit history, which can unlock better loan terms in the future.

- Fast and digital application process with funds disbursed directly to the bank account.

Considerations:

- The effective loan amount is reduced due to upfront fees and taxes.

- Short repayment period (7 days) may be challenging for some borrowers.

- High interest rates compared to traditional loans, typical of short-term lending apps.

Who Should Use It?

Score Climb Credit Growth is best suited for individuals looking to cover minor expenses while simultaneously working on building their credit score. Responsible repayment is crucial to maximize the credit-building benefit.

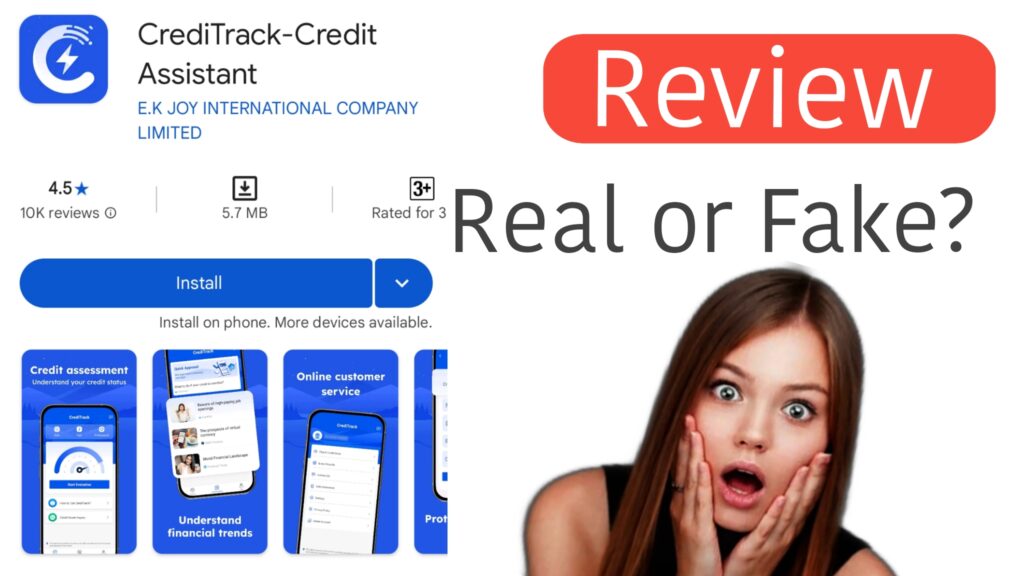

2. Creditrack Loan App: Quick Cash with High Costs

Creditrack Loan App is another 7-day loan app that provides instant loans without requiring a CIBIL score or income proof. While it offers rapid access to funds, it comes with notably high interest rates and charges, making it a costly borrowing option

Key Features:

- Loan Amount: Provides small loans, typically in the range of ₹1,000 to ₹5,000.

- Repayment Tenure: Loans are due within 7 days.

- No CIBIL or Income Proof: Approves loans based on alternative data, such as KYC verification and banking history.

- High Interest and Fees: Charges steep interest rates and processing fees, significantly increasing the repayment amount.

Benefits:

- Instant loan approval and disbursal, often within minutes.

- No need for a credit history or income documentation, making it accessible to a wide audience.

- Fully digital process, eliminating the need for physical paperwork.

Considerations:

- Extremely high interest rates and fees can make repayment burdensome.

- Short 7-day tenure requires careful financial planning to avoid defaults.

- Risk of a debt trap if loans are not repaid on time, as penalties may accrue.

Who Should Use It?

Creditrack Loan App is suitable for users facing urgent financial needs and confident in their ability to repay within a week. Borrowers should exercise caution due to the high costs and prioritize timely repayment to avoid additional charges.

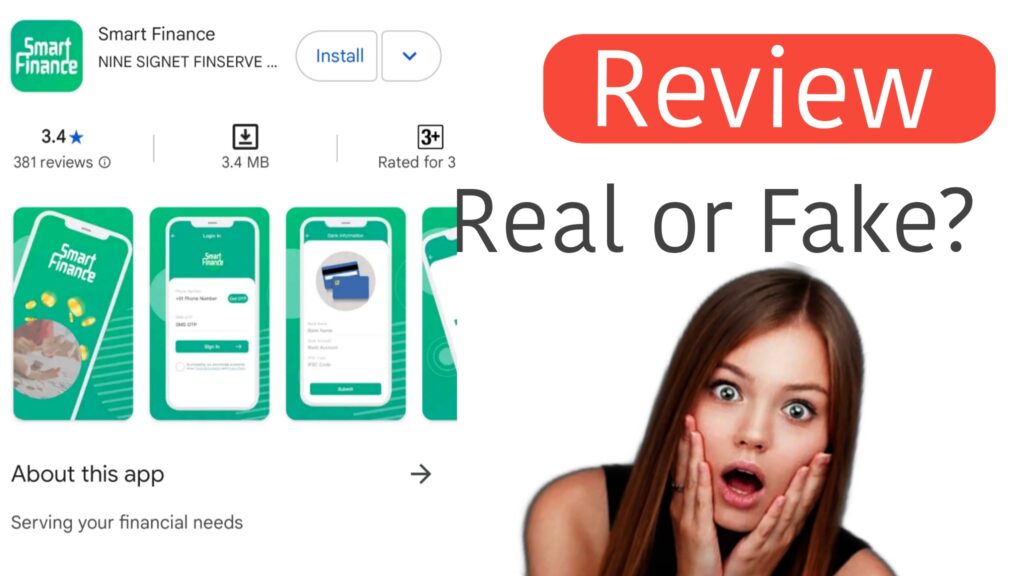

3. Smart Finance Loan App: Fast Loans for Urgent Needs

Smart Finance Loan App is a 7-day loan app designed to provide quick financial relief without the barriers of CIBIL score checks or income proof requirements. It focuses on delivering small, short-term loans to address immediate cash shortages.

Key Features:

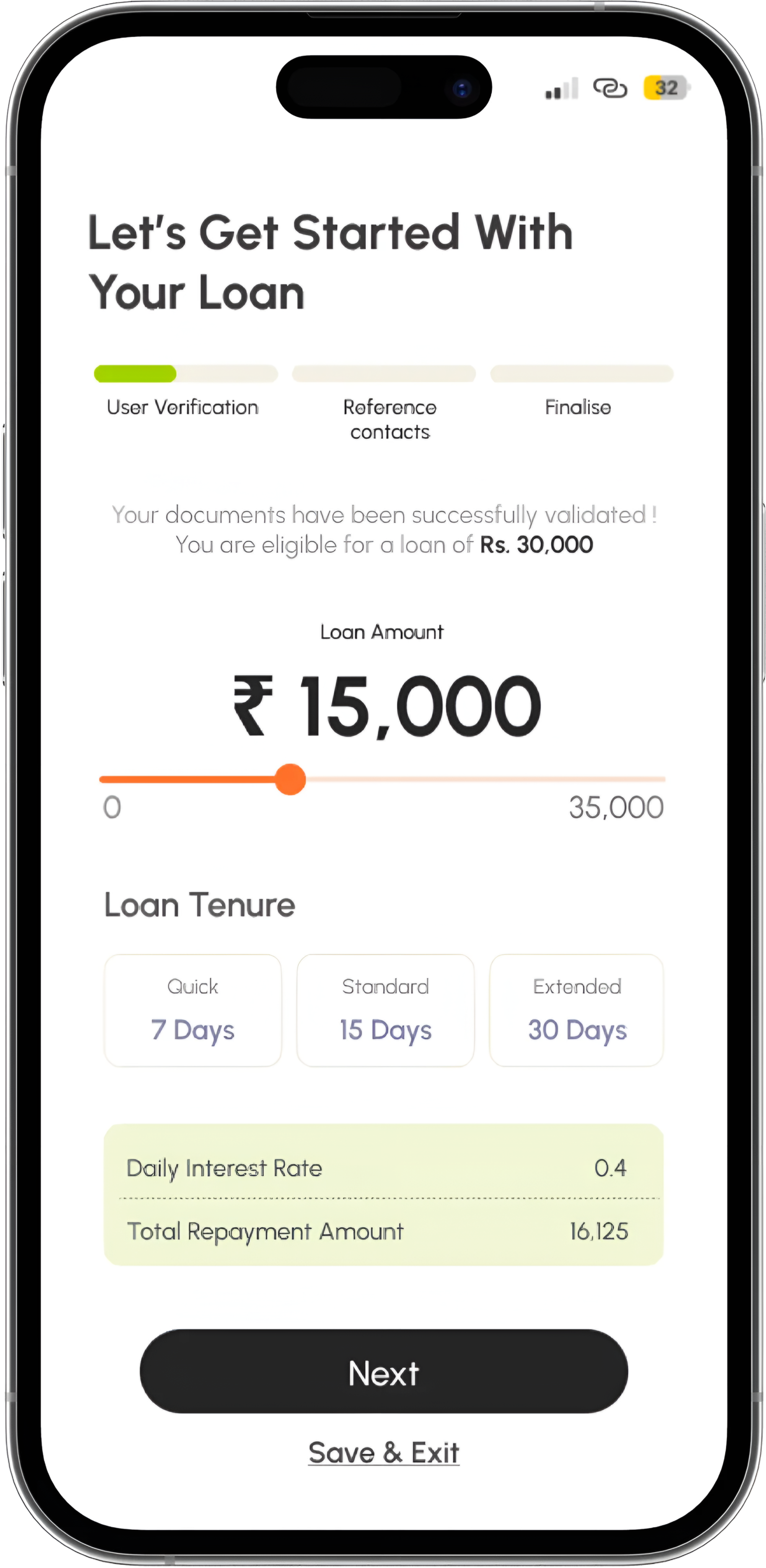

- Loan Amount: Offers loans ranging from ₹1,000 to ₹5,000, depending on eligibility.

- Repayment Tenure: Loans must be repaid within 7 days.

- No CIBIL or Income Proof: Relies on minimal KYC documentation (Aadhaar, PAN) for loan approval.

- Digital Process: Entire application and disbursal process is online, ensuring speed and convenience.

Benefits:

- Quick access to funds, ideal for emergencies like medical bills or unexpected expenses.

- No credit score or income proof requirements, making it inclusive for new borrowers.

- User-friendly interface for seamless loan applications.

Considerations:

- High interest rates and processing fees, common in short-term loan apps.

- 7-day repayment period may strain finances if not planned properly.

- Limited loan amounts may not suffice for larger financial needs.

Who Should Use It?

Smart Finance Loan App is ideal for individuals needing small, short-term loans to tide over temporary cash shortages. Borrowers must ensure they can repay within the 7-day window to avoid penalties.

Why Choose Loan Apps Without CIBIL Score or Income Proof?

These three loan apps—Score Climb Credit Growth, Creditrack Loan App, and Smart Finance Loan App—cater to a growing demand for accessible financing in 2025. Here’s why they stand out:

- Inclusivity: By eliminating the need for CIBIL scores and income proof, these apps make loans available to students, freelancers, and others who may lack traditional credit or income documentation.

- Speed: All three apps offer instant approvals and disbursals, ensuring funds are available when needed most.

- Minimal Documentation: Requiring only Aadhaar and PAN for KYC verification simplifies the borrowing process.

- Credit-Building Potential: Apps like Score Climb Credit Growth help users establish a credit history, paving the way for better financial opportunities.

Things to Keep in Mind Before Borrowing

While these apps provide quick access to funds, they come with risks that borrowers should consider:

- High Costs: Short-term loans often carry high interest rates and fees, increasing the overall repayment amount. For example, a ₹1,500 loan from Score Climb Credit Growth may result in only ₹900 disbursed after deductions.

- Short Repayment Tenure: The 7-day repayment period requires careful budgeting to avoid defaults, which can lead to penalties or damage to credit profiles.

- Risk of Debt Trap: Frequent borrowing or failure to repay on time can trap users in a cycle of debt, especially with high-cost apps like Creditrack Loan App.

- Verify Legitimacy: Ensure the app is registered with the Reserve Bank of India (RBI) or partnered with an RBI-approved NBFC to avoid fraudulent platforms.

How to Apply for Loans with These Apps

The application process for these loan apps is straightforward and fully digital:

- Download the App: Install the app from the Google Play Store or Apple App Store.

- Register: Sign up using your mobile number and complete KYC verification with Aadhaar and PAN details.

- Select Loan Amount: Choose the desired loan amount and review the terms, including fees and interest.

- Receive Funds: Upon approval, funds are credited directly to your bank account, often within minutes.

- Repay on Time: Ensure repayment within 7 days to avoid penalties and, in the case of Score Climb Credit Growth, to boost your credit score.

Conclusion

In 2025, Score Climb Credit Growth, Creditrack Loan App, and Smart Finance Loan App are redefining access to instant loans by removing the barriers of CIBIL score and income proof requirements. These 7-day loan apps offer quick, small-scale financial solutions for urgent needs, with Score Climb Credit Growth standing out for its credit-building feature. However, borrowers must approach these apps with caution due to high interest rates, fees, and short repayment periods.

Before applying, assess your repayment capacity and verify the app’s credibility to ensure a safe borrowing experience. By using these apps responsibly, you can address immediate financial needs and, in some cases, lay the foundation for a stronger credit profile