New Loan App Without Income Proof 2025 : आधार कार्ड से लोन

Hello dosto aaj ke is post me ham do aisi new loan company ke bare me apko bataenge jisme loan lene ke liye apko koi bhi income proof aur cibil score ki jarurat nhi h aap bahut hi aasani se in application se personal loan prapt kar sakte hai vah bhi 1000 se lekar pure ke pure 5 lakh rupay Tak keval apke Aadhar card aur Pan Card me to pura post achhe se padhe aur hamne kuchh tarike bataye hai jaha se aap in application me loan apply karege aur post ke neeche hamne in application ke link bhi de rakhe hai jaha se aap directly loan apply bhi kar sakte hai.

Required Documents

- Aadhar card for address verification

- Pan card for cibil score

- Applicants age must be more than 25 years

- Active bank account

- No loan default in last 3 months

Eligibility Criteria

- Indian adult citizen

- Valid pan card

- Salaried Individuals

- Above the age of 18 years

- Minimum take home salary per month 10,000

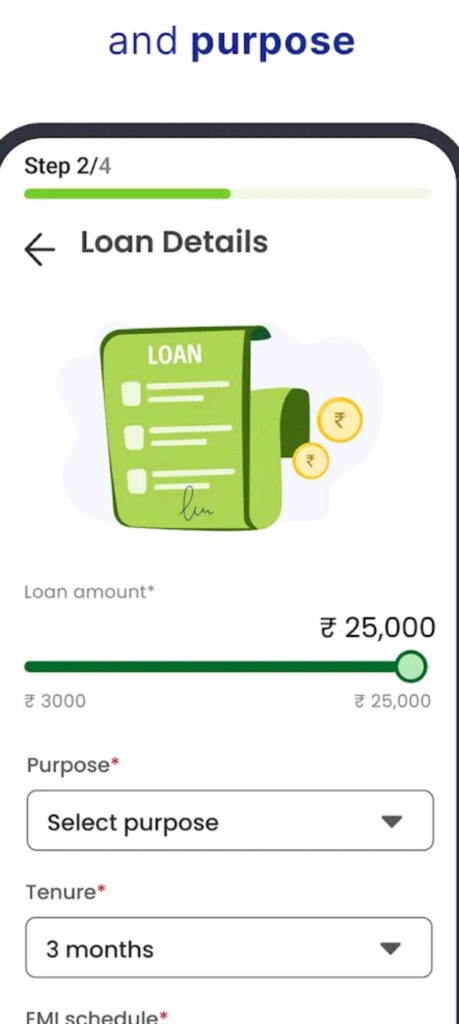

1. Kredito 24Finance Loan App Review 2024

DIGIMONEY insta loan app is a lending app developed by DIGIMONEY Finance private limited a non banking finance company licensed by reserve Bank of India this app is a very trusted application and easy applying process.

Kredito 24 Loan insta loan app makes the whole lending process digital and automated the entire process right from

1) User registration through OTP confirmation

2) Customer identification validation

3) Credit evaluation using analysis of financial SMS data

4) Loan approval

5) Loan agreement signing

6) e-mandate for loan collection/repayments

7) Disbursement

is digital as the user navigates through the process and on completing step 6 as outlined above the loan is Disbursed instantly and is credited to customers designed bank account

With kredito 24 insta loan app customers can get their loan disbursed and have the money credited in their bank account in less than 10 minutes

A complete digital lending platform seamless process affordable interest rates and no more hassles of bank visits etc. currently personal loans range from 10,000 to 100,000.

Terms :

- Loan : 10,000 to 100,000

- Loan period : minimum 3 months to maximum 12 months

- Annual percentage Rate or interest rate : 10% – 24% per annum depending upon results of our credit risk assessments

- Processing fee : 1000 onwards

EXAMPLE :

If the loan amount is 10,000 & interest is 10% per annum with minimum Repayment period of 3 months interest = 167 and total amount payable would be rs. 10,167

One time processing fees is 1000 plus GST the amount disbursed to borrower’s registered bank account is 9,000 the equated monthly EMI is 3,389

Why choose kredito 24 :

- Ease of availing loans, depending on the need and circumstances of the customer

- Lowest processing fee flat at 1000

- Lowest interest rates, starting at as low as 10 % per annum diminishing less than the top banks

- No documents upload required

- Quickest processing, registration to Disbursement in less than 10 minutes

- Flexible term & flexible EMI

Your data is safe with us protection of your privacy and your data security is top priority at DIGIMONEY all transactions are secured using 128 – bit SSL encryption and adequate firewalls to control the APIs with multiple level authentication, Authorization and verifications

Registered office address :

4th floor, Salzburg square, 107, Harrington road, chetpet,

Chennai – 600031

Reach us at info@digimoneyfinance.com or contact us 18005728428 for any of your queries

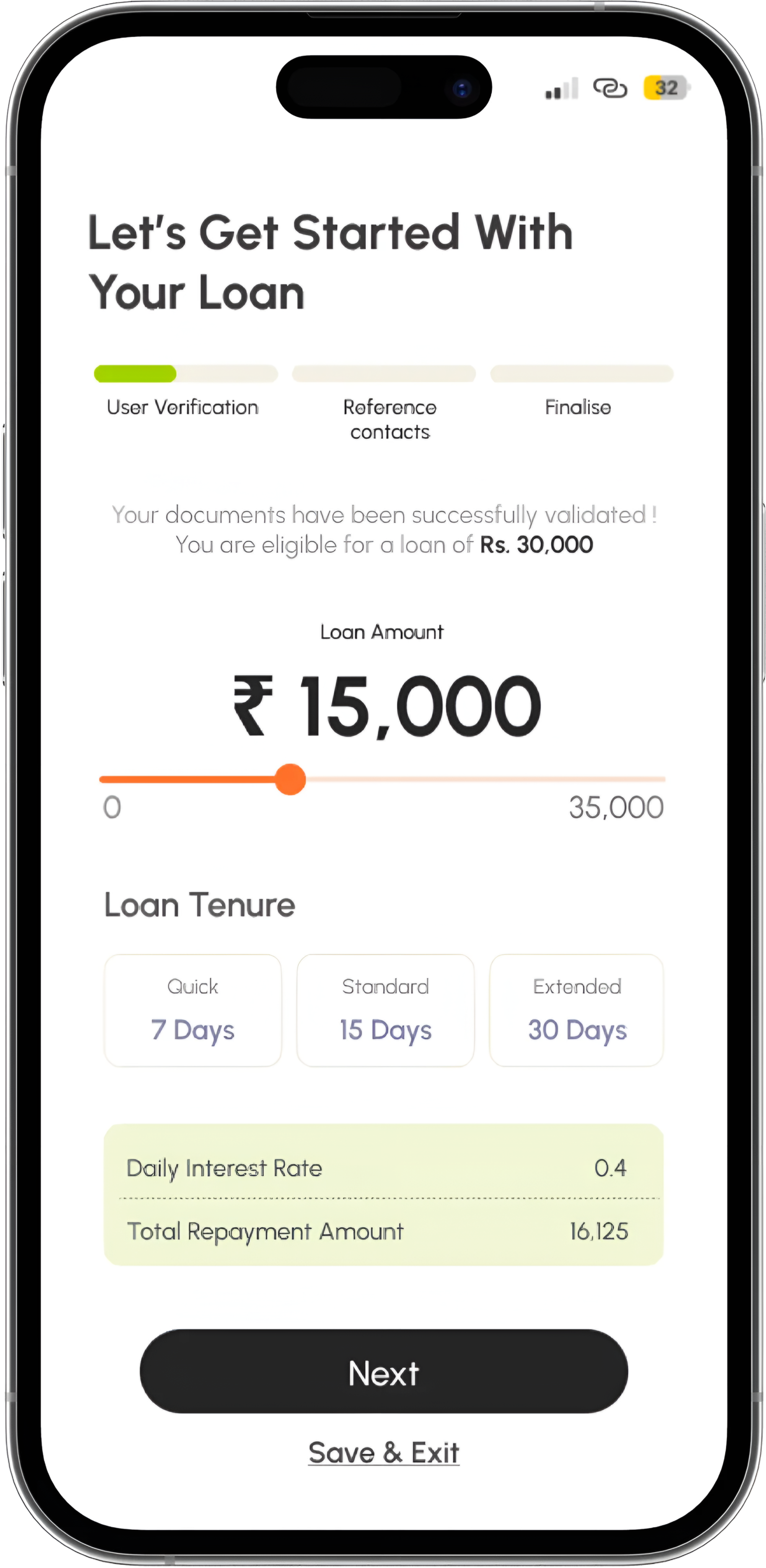

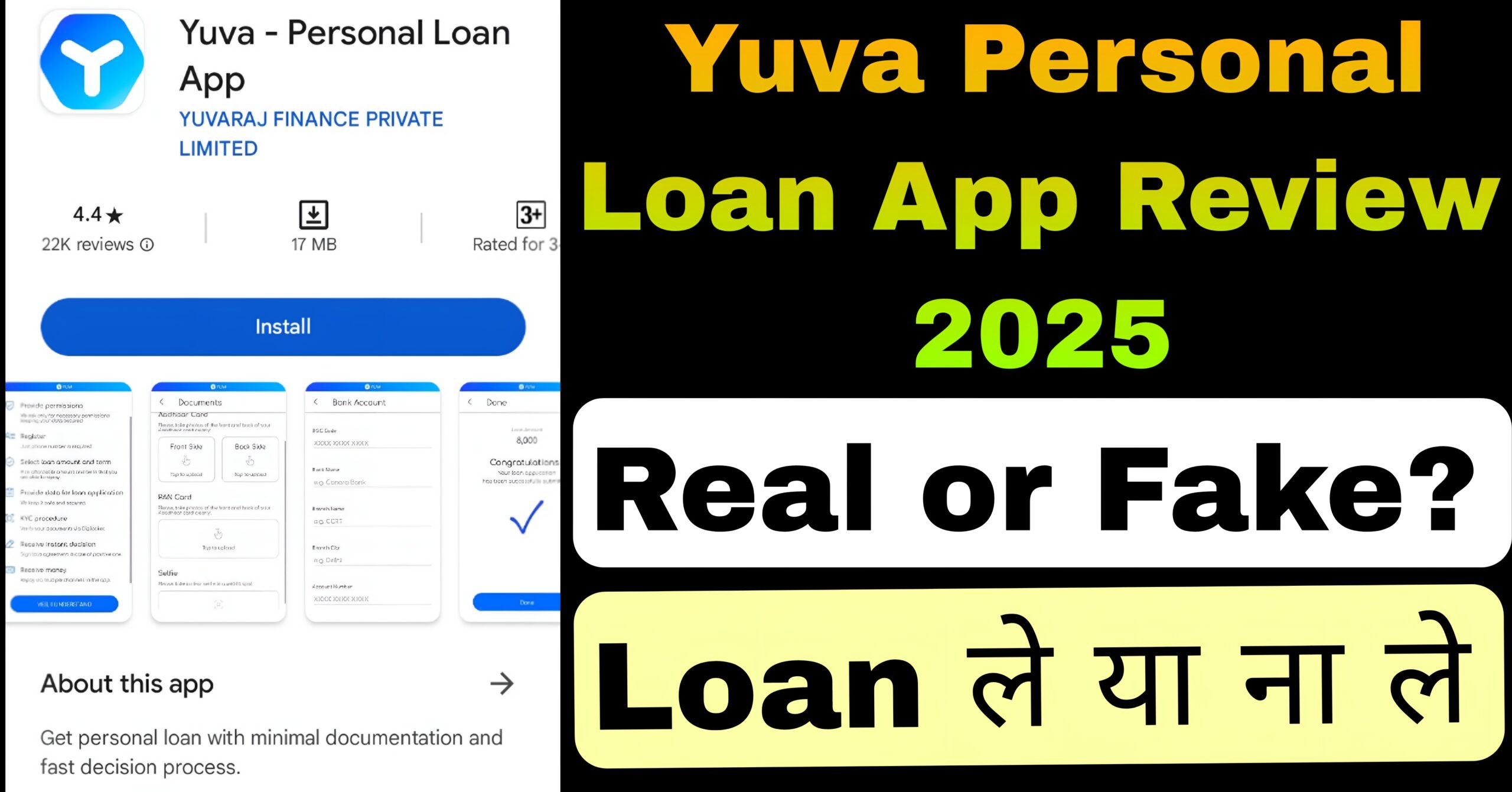

2. Rapid Rupee – Personal Loan App Review 2024

Rapid Rupee personal loan app our facilitates money lending by registered Non banking financial company – YUVARAJ FINANCE PRIVATE LIMITED. Fast process instant personal loan app. No membership or upfront fees Rapid rupee is a personal loan app that offers instant loan online.

- Instant personal loans from 500 to 20,000 (pan India)

- Terms from 61 to 365 days

- Maximum APR which includes interest rate plus fees : 89.8%

- Fast decision 24/7

- Interest rate from 12% to 36% per annum

- Processing fees starts at just rs. 99

- No membership or upfront fees loan amount is paid out in full

Rapid Rupee is a personal loan app that offers instant loans online apply for an instant loan and receive direct cash transfer to your bank account

Types of instant loans we provide:

Personal Loans for Salaried professionals : who can recieve advance salary loans to cover small but urgent needs and have money transferred straight into their bank account

Small personal loans : Get quick personal loans online

Cash Loan : our cash loans can help you cover everything from monthly grocery Bill’s to children school fees and even outstanding bills that need to be cleared

Loans for self employed : we accept both self employed professional and salaried applicants.

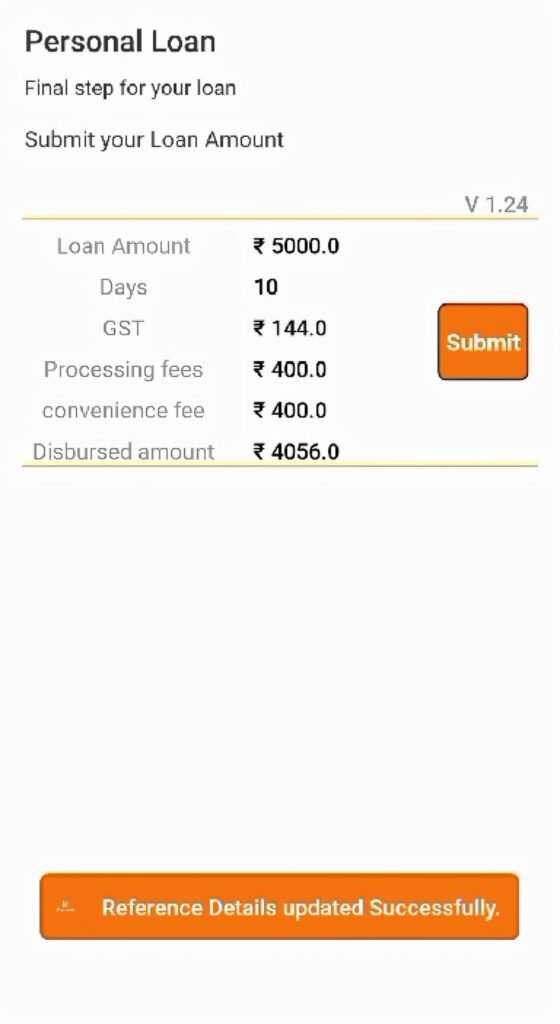

Representative cost of a rapid rupee instant personal loan including all applicable fees :

If the loan amount is 4,000 and the period for repayment is 90 days, interest is 12% p.a with a one time onboarding fee of 599 then the total cost of the loan is 4,000 12% 90/365 + 599 = 118 + 599 = 717 and the total amount payable 4,717 with monthly payment 1,572

Why Rapid Rupee ? Here are some of the features of our Instant Loan App :

- Fast journey from loan application to decision

- Online loan app in India with 24/7 availability

- Only Aadhar, pan card, and selfie required

- Pan India presence

Our Instant loans are safe :

Your data is safe with us it is transferred Over a secure HTTPS connection and we do not share it with anyone without your consent all transactions are secured using 128 – bit SSL encryption