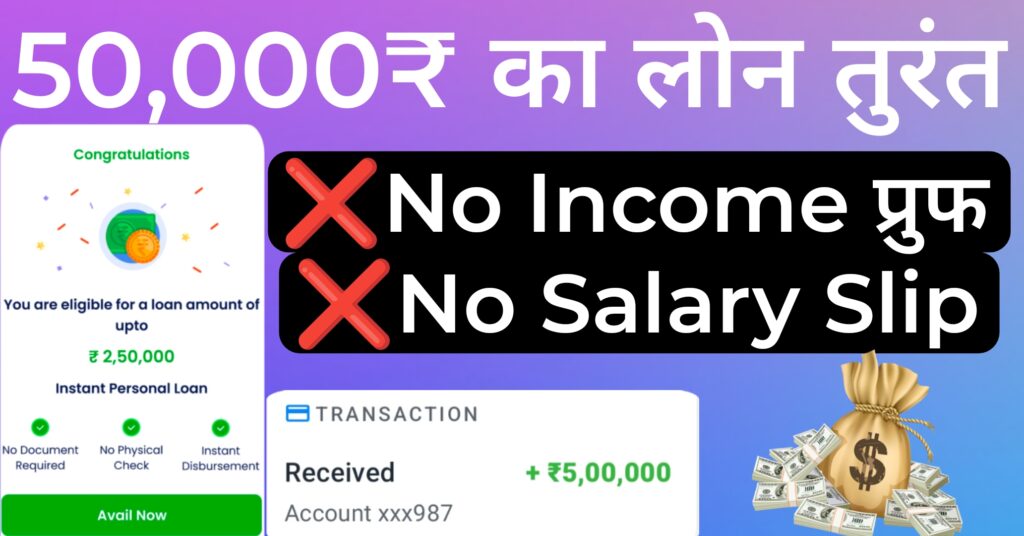

50,000 Urgent Cash Loan App: Urgent Loan 2024

50,000₹ urgent cash loan app: हेलो दोस्तों अगर आपको भी पर्सनल लोन की जरूरत पड़ गई है तो आज हम यहां पर आपको एक ऐसी लोन कंपनी के बारे में बताएंगे जिसमें आपको किसी भी तरह के एकदम प्रूफ की जरूरत नहीं पड़ेगी और आपका अगर सिविल काम भी है तो भी बहुत ही आसानी से आपको इस कंपनी के द्वारा पर्सनल लोन प्राप्त हो जाएगा इस कंपनी की सबसे खास बात यह है कि यह कंपनी बहुत ही आसानी से लोन प्रदान कर देती है सिर्फ आधार कार्ड और पैन कार्ड में पूरी जानकारी हम इस लोन कंपनी की लेने वाले हैं

50,000 urgent loan app की जानकारी

- इस लोन एप्लीकेशन के गूगल प्ले स्टोर पर 50 मिलियन से ज्यादा के डाउनलोड हो चुके हैं

- यह एप्लीकेशन केवल आधार कार्ड और पैन कार्ड की मदद से लोन देती है

- इस लोन ऐप के 4.4 स्टार से ज्यादा की रेटिंग्स है

- लाखो करोड़ों लोग पहले से ही इस लोन ऐप का उपयोग करते है

- इसमें अप्लाई करना बच्चो का खेल है

- ये अर्जेंट लोन ऐप आपको कम से कम 5000 का लोन और ज्यादा से ज्यादा 1 लाख का लोन प्रदान करती है

Emergency Cash loan के लिए : डॉक्यूमेंट क्या लगेगा

- अगर आपको इस लोन कंपनी से अर्जेंट लोन लेना है तो आपको सबसे पहले आधार कार्ड देना होगा जो आपका एड्रेस प्रूफ साबित करेगा

- दूसरा सबसे जरूरी डॉक्यूमेंट है आपका पैन कार्ड इससे आपका सिबिल स्कोर चेक होता है सिबिल स्कोर ज्यादा होने से आपका ब्याज दर कम लगता है

- आपके पास एक एक्टिव बैंक अकाउंट भी होना चाहिए जिसमें आपका लोन आएगा

- आप भारत के एक नागरिक होने चाहिए

- आपकी उम्र 21 साल से ज्यादा होना चाहिए वह 60 साल से कम होना चाहिए

50,000 Urgent Cash Loan अप्लाई कैसे करें?

इस लोन को अप्लाई करने के बहुत सारे तरीके हैं उनमें से हम हर एक तरीका आपको बताएंगे और हम डायरेक्ट लिंक भी दे रहे हैं यहां पर लोन अप्लाई करने का उसे लिंक के द्वारा आपको लोन अप्लाई करना है ताकि आपका अप्रूवल बहुत ही जल्दी आए

इन बातो का रखे ध्यान लोन लेते वक्त

दोस्तों लोन लेने वक्त इस बात का ध्यान हमेशा रखिएगा कि अगर आप किसी कंपनी से लोन ले रहे हैं तो आपको समय से भुगतान करना बहुत ही ज्यादा जरूरी है नहीं तो अगर आप समय से भुगतान नहीं करते तो आपका जो सिविल स्कोर है वह खराब हो जाता है और बाद में लोन कंपनी आप पर प्रेशर बनती हैं लोन चुकाने का इससे अच्छा होगा कि आप समय से भुगतान करें और सिविल स्कोर अच्छा करें ताकि कंपनी भविष्य में आपको एक बड़ा लोन दे सके