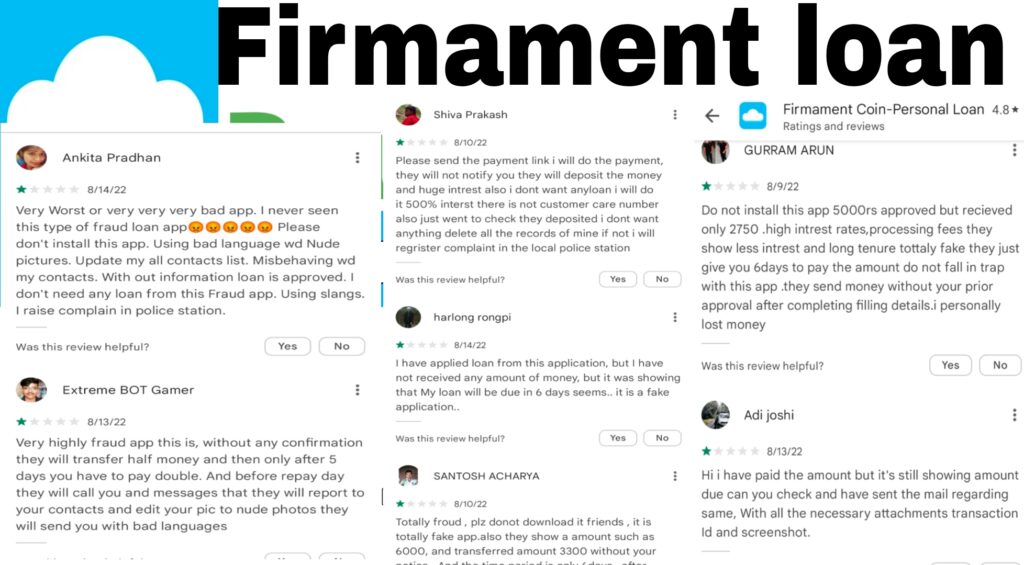

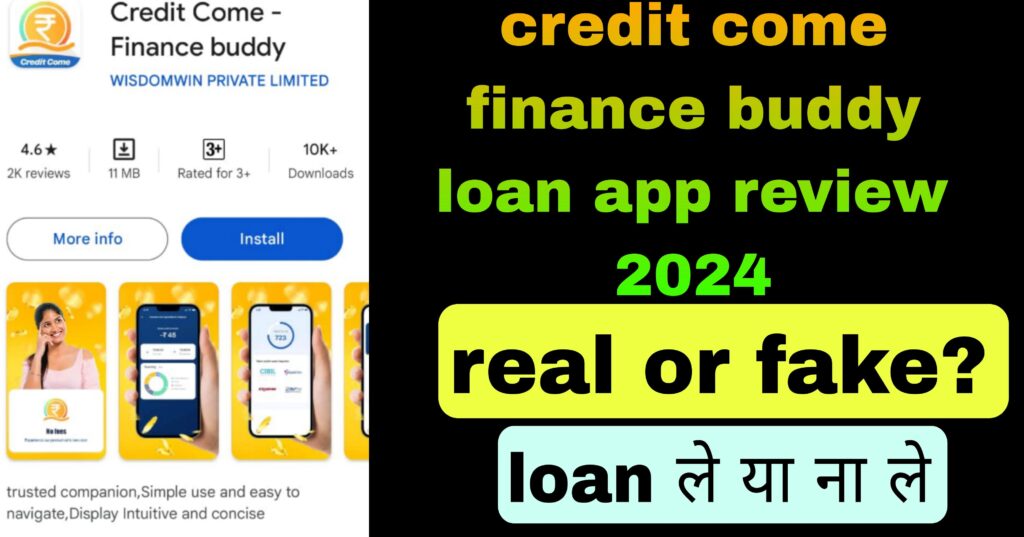

CREDIT COME – FINANCE BUDDY LOAN APP REVIEW 2024

credit come – finance is your trusted financial partner that provides you with a comprehensive view of your financial health.

Quickly view your credit score, track you bank balance and gain insight into your income and expenditure analysis,

use these insights to make your financial healthier and also make you more competitive when applying for loans. Enabling you to make smart financial decisions, all under you control.

Unlock your borrowing potential and achieve your goals with credit come – finance buddy.

Noted : we are not a lender we only only provides a platform to guide users to check credit score, check bank balance, income and expenditure analysis

credit Come लोन ऐप Real है या fake?

दोस्तों यह एक 7 दिन की लोन एप्लीकेशन है और एक फेक एप्लीकेशन है यह एप्लीकेशन लोन तो देती है लेकिन आपसे 7 दिन के अंदर 2 गुना पैसा वसूल करती है इसीलिए आप अपनी रियल कांटेक्ट लिस्ट या फिर रियल कॉल लॉक्स के द्वारा लोन अप्लाई ना करें आप किसी ऐसे डिवाइस का उसे कर सकते हैं जिसमें आपका कोई भी उत्तर सही नहीं हो क्योंकि एक फर्जी कंपनी है और सही तरीके से इस पर लोन अप्लाई नहीं किया जा सकता

FEATURES OF CREDIT COME – LOAN

- user friendly graphics interface

- Simple use and easy to navigate

- display Intuitive and concise

- completely Spam – free and add – free

- No fees

credit come – finance buddy is the perfect solution for anyone looking to take control of their financial health and to know credit score, bank balance,

income and expenditure and is the ultimate tool for anyone looking to achieve financial stability and freedom experience the power of worry – free borrowing with credit come – financial buddy.

safe And secure :

None of your information is shared with any third party or institution without permission. Your data is safe with us.

for help email us at analysis@ cashcome.in.

Address : yashodham, goregaon, Mumbai, Maharashtra 400063