Fashion Rupee Loan App: Real or Fake? 7 Day Loan App

Are you considering the Fashion Rupee loan app for a quick financial fix? Think twice before diving in. Marketed as a legitimate 7-day loan app with ties to a registered NBFC, Fashion Rupee promises convenience and transparency. However, its glossy description clashes with customer reviews alleging high interest rates, fraud, and even photo morphing. In this article, we’ll unpack whether Fashion Rupee is a genuine option or a potential scam, diving into its claims, customer feedback, and the broader context of loan app fraud in India.

What is Fashion Rupee Loan App?

Fashion Rupee positions itself as an intermediary connecting users to its partner NBFC, Jayachelve Financing And Leasing Private Limited, which it claims is registered and regulated by the Reserve Bank of India (RBI). Unlike direct lenders, Fashion Rupee facilitates loans, emphasizing a safe and compliant service. Here’s what the app promises:

Loan Details

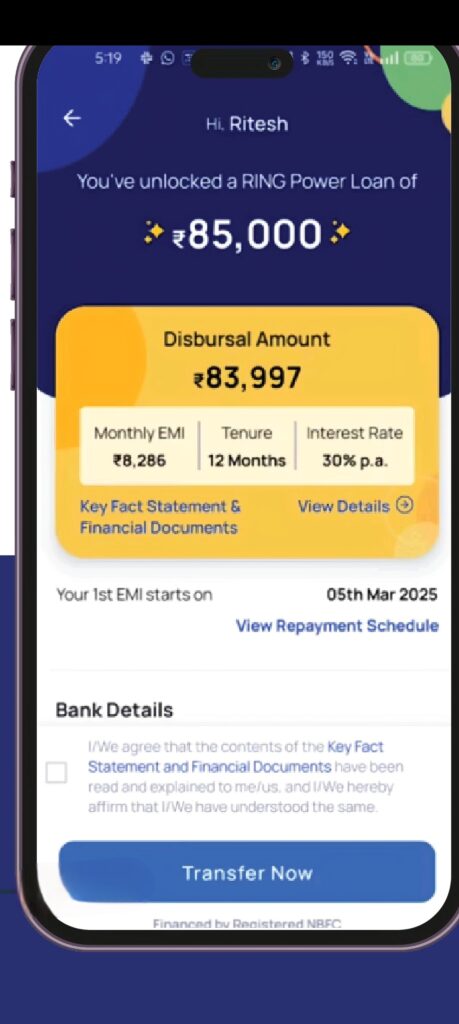

- Loan Amount: ₹5,000 to ₹100,000

- Maximum Annual Interest Rate (APR): 22%

- Handling Fee: Up to 1% of the loan amount + 18% GST

- Repayment Period: 100 to 730 days (though marketed as a 7-day loan app)

Loan Calculation Example

For a ₹20,000 loan with a 180-day term and 20% APR:

- Handling Fee: ₹200 (1% × 20,000)

- GST: ₹36 (18% × 200)

- Interest: ₹1,972.6 (20,000 × 20% × 180/365)

- Total Loan Cost: ₹2,208.6 (200 + 36 + 1,972.6)

- Total Repayment: ₹22,208.6 (20,000 + 2,208.6)

- Monthly Repayment: ₹3,701.4 (22,208.6 ÷ 6)

Key Features

- 100% online application process

- Competitive loan amounts and interest rates

- Transparent and secure processes

- Absolute information security

Eligibility

- Indian nationals

- Age: 20–55 years

- Stable employment with steady income

At first glance, Fashion Rupee looks appealing. But the claim of being a 7-day loan app conflicts with the 100–730-day repayment period in its description, sowing seeds of confusion. Customer reviews further muddy the waters.

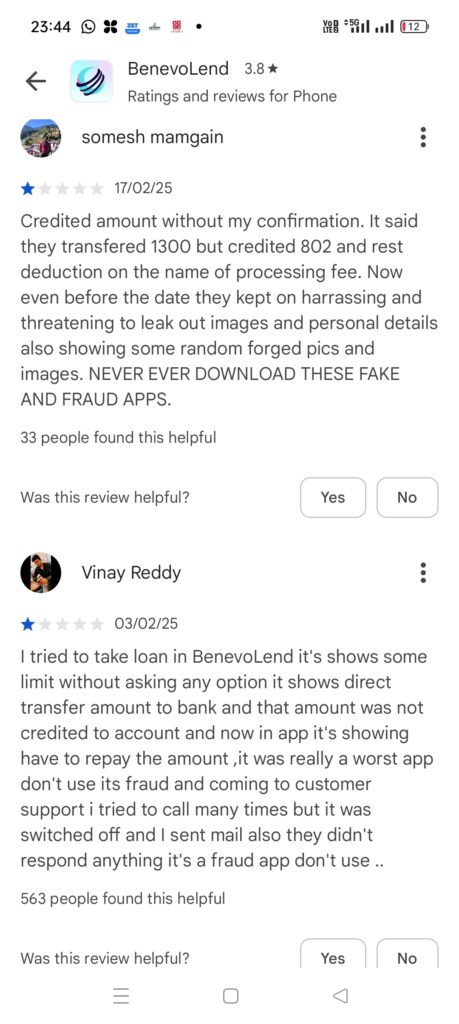

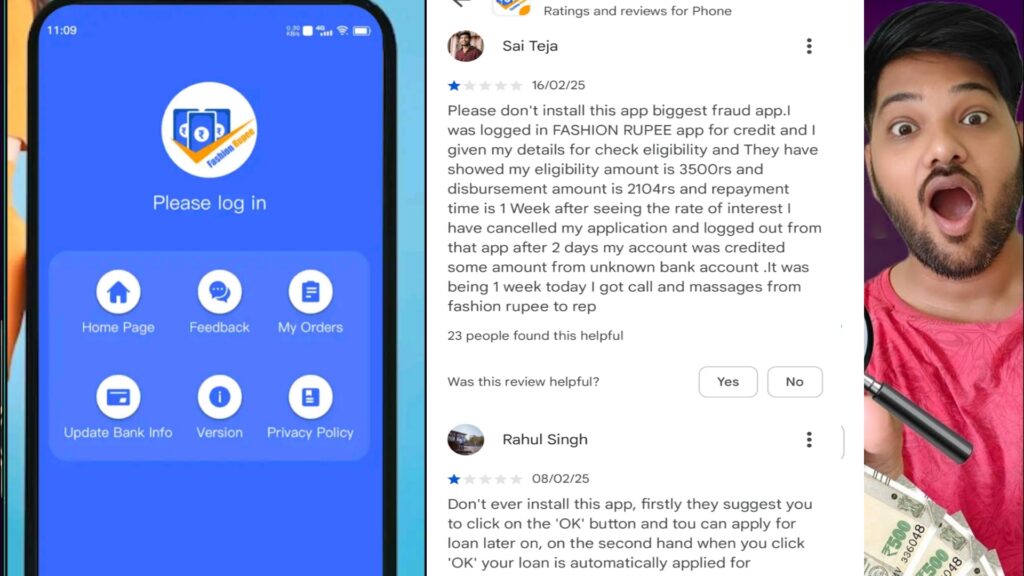

Customer Reviews: Fraud and Photo Morphing Allegations

Despite its polished marketing, Fashion Rupee has drawn sharp criticism from users. Here are two telling reviews:

- Manohar Manu (5 February 2025):

“This is a fake app. We just given details and waiting to submit application. Without any response, they kept hold and sent 1200rs. Later they asked me to pay 3200rs. They sent a morphed photo to me and blackmailed to pay. I said, No problem, please give me some Fan base. But still why play store is supporting this app.” - Chinthapally Shiva (31 January 2025):

“Rupees app, highlighting fraud issues and photo morphing. I recently used the Fashion Rupees app and was thoroughly disappointed with my experience. The app, which initially seemed like turned out to be full of issues, mainly concerning fraudulent activities and photo manipulation. Plz don’t install this kind of app (fashion rupees).”

These reviews spotlight serious red flags:

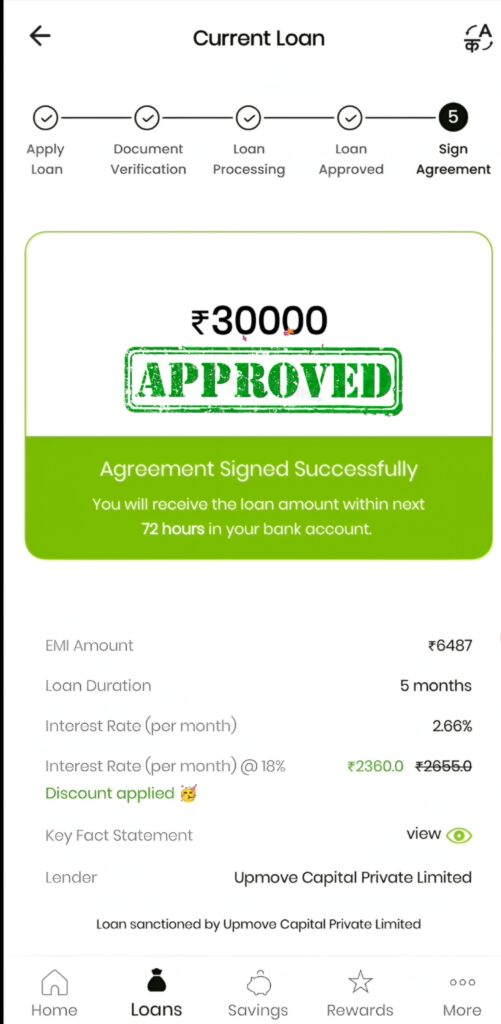

- Unsolicited Loans: Small amounts credited without consent.

- Exorbitant Repayments: Demanding ₹3,200 for a ₹1,200 loan suggests hidden fees or sky-high interest rates.

- Blackmail via Photo Morphing: Using altered photos to harass users into repayment—a tactic linked to predatory apps.

Such experiences clash with Fashion Rupee’s “transparent and secure” branding, raising the question: Is Fashion Rupee legit or a scam?

Is Fashion Rupee Real or Fake?

To answer this, let’s weigh its claims against the evidence.

NBFC Registration: A Legit Starting Point?

Fashion Rupee ties its legitimacy to Jayachelve Financing And Leasing Private Limited, claiming RBI registration. If true, this offers some credibility—you can verify this on the RBI’s NBFC list. However, registration doesn’t guarantee ethical behavior. Many fraudulent apps hide behind legitimate-sounding affiliations while flouting RBI guidelines.

Conflicting Claims

The app’s description lists repayment terms of 100–730 days, yet it’s marketed as a 7-day loan app with allegedly very high interest rates. This discrepancy suggests either misleading advertising or a bait-and-switch tactic—common among scam apps.