BetterPlace Money Loan App Review 2025: Sach Kya Hai?

Intro: Ek Nayi Duniya of Digital Lending

Aaj ke fast-paced zamane mein, jab paise ki zarurat ek dam se pad jati hai, apps like BetterPlace Money frontline workers ke liye ek nayi ummeed ban kar ubhre hain. Yeh app chhote, instant loans ka wada karta hai, wo bhi bina kisi bade jhanjhat ya paperwork ke. Par kya yeh sach mein itna simple aur reliable hai? Aao, 2025 ke is review mein BetterPlace Money ke features, faayde, nuksaan, aur asli user reviews ke saath iski gehrai mein utarte hain, ek unique style mein, taaki yeh bilkul fresh lage!

BetterPlace Money Kya Hai?

BetterPlace Money, jo BetterPlace Safety Solutions Pvt Ltd ne banaya hai, ek aisa platform hai jo India ke frontline workers—like delivery boys, gig workers—ke liye financial help deta hai. Yeh NBFCs jaise Liquiloans (NDX P2P Pvt Ltd) ke saath milke ₹25,000 tak ke personal loans deta hai, wo bhi bina kisi guarantee ke. Google Play Store pe iske 1.6 million+ downloads hain aur 2025 tak 2 lakh se zyada loans sanction ho chuke hain. Yeh app simplicity aur financial inclusion pe focus karta hai, par isme kitna dum hai, yeh dekhte hain.

Features: Kya Kya Milta Hai?

- Loan Amount aur Tenure

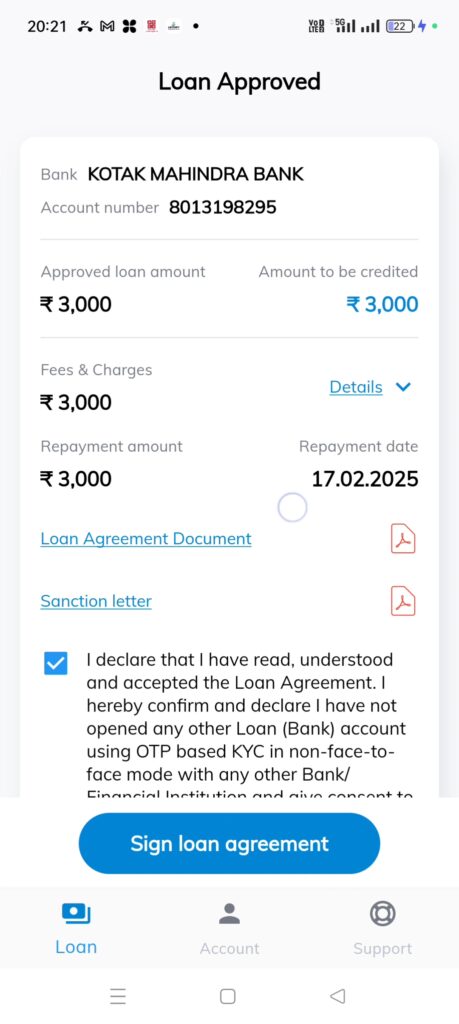

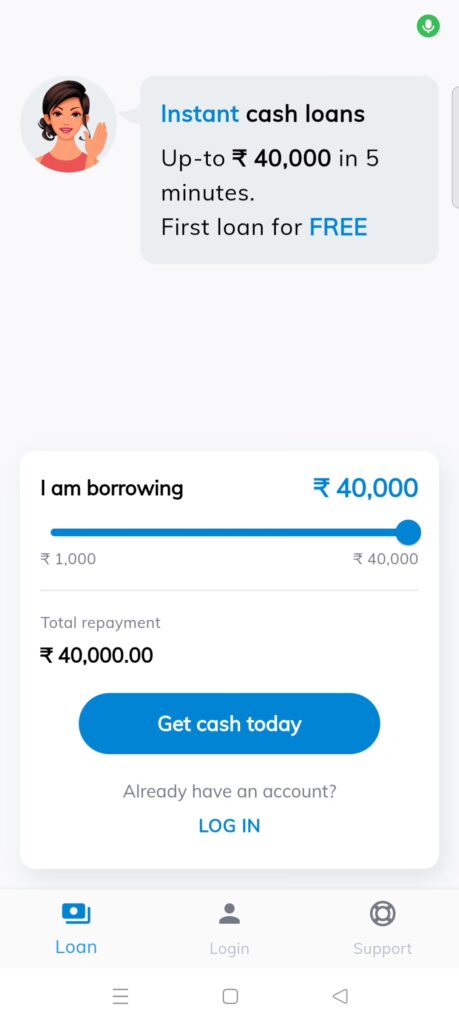

- ₹25,000 tak ka loan mil sakta hai.

- Repayment 3 se 6 mahine ka hota hai, jo short-term needs ke liye perfect hai.

- Misal ke taur pe: ₹10,000 ka loan agar 1.5% monthly interest pe 3 mahine ke liye liya, toh ₹450 interest + ₹300 processing fee, matlab total ₹10,450 repay karna hoga (APR: 30.4%).

- Interest aur Fees

- Interest rate 1% se 3% monthly (20% se 50% APR), jo kaafi high hai.

- Processing fee ₹200 se ₹600 tak (GST alag se).

- App ka dawa hai ki koi chhupi fees nahi, jo transparency dikhaata hai.

- Eligibility aur Documents

- Indian citizen hona chahiye, umar 20+ honi chahiye, aur Aadhar/PAN jaise basic ID proofs chahiye.

- Sab kuch digital hai—no need to visit any office!

- App ka Interface

- 2 minute mein loan apply kar sakte ho, itna simple hai.

- Loan status track karo, direct app se payment karo, aur agar time pe repay karo toh bada loan mil sakta hai.

- Employer Connection

- Yeh app companies ke saath tie-up karta hai taaki unke workers ko loans mile.

- Swiggy jaise platforms ke delivery boys ke liye yeh kaafi popular hai, with features like WageBetter for early salary access.

Faayde: Kyun Pasand Karna Chahiye?

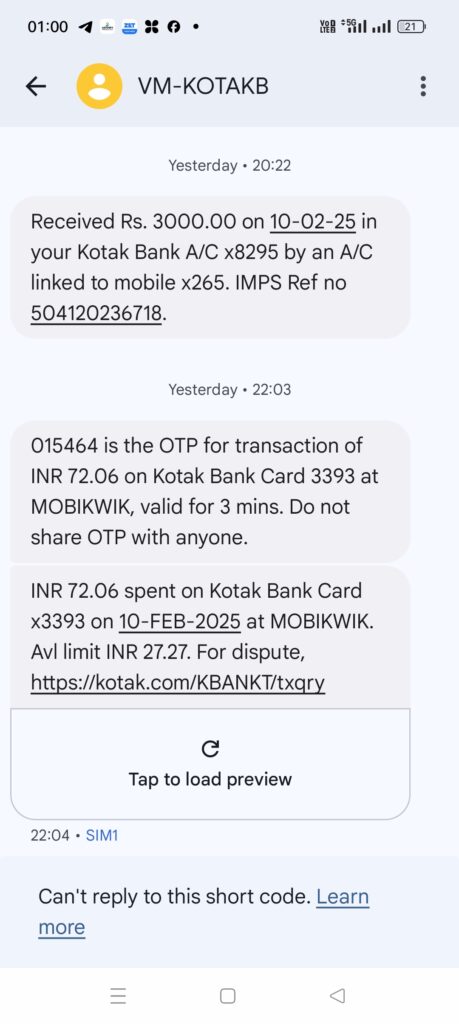

- Jaldi Paise: Loan approve hote hi paise bank account mein, sometimes in hours!

- Aasani: Low credit history walon ke liye bhi chance, jo financial inclusion ko badhawa deta hai.

- No Collateral: Koi cheez girvi rakhne ki zarurat nahi.

- Digital Vibes: Paperless process aur 24/7 access, perfect for busy life.

- Clear Terms: Interest, fees sab clear bataye jaate hain, no hidden shocks.

Nuksaan: Kahan Hai Problem?

- Zyada Interest: 20-50% APR bank loans (jaise SBI ka 10.99%) se kaafi costly hai. Low-income workers ke liye yeh bojh ban sakta hai.

- CIBIL ka Jhol: Kai users bolte hain ki time pe payment ke bawajood app late payment mark karta hai, jisse CIBIL score gir jata hai (jaise 750 se 701).

- Customer Support ka Rona: Email ya WhatsApp pe reply nahi milta, aur call support toh hai hi nahi.

- Tech Issues: OTP ya verification ke time glitches, jo process rok deta hai.

- Chhota Loan: ₹25,000 ki limit badi zaruraton ke liye kaafi nahi.

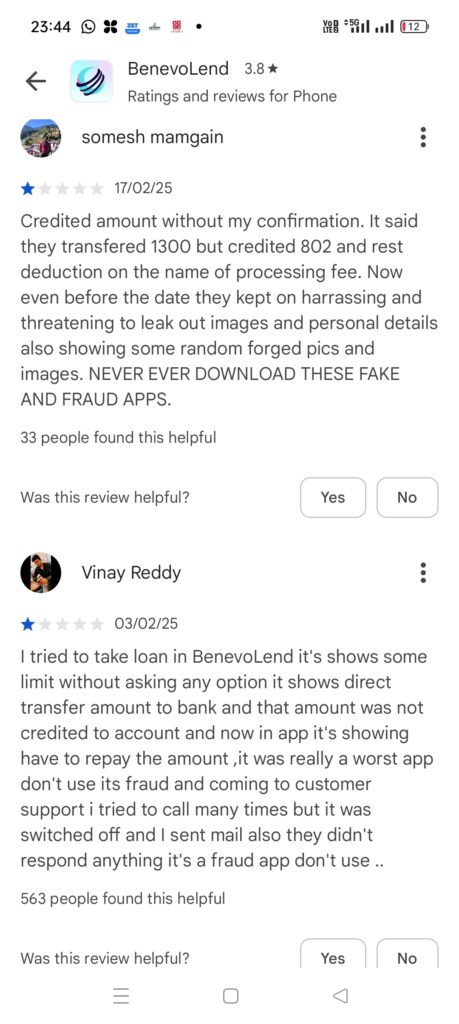

Asli Users Ka Feedback: Suno Dil Se

Yeh app kisi ke liye game-changer hai, toh kisi ke liye headache. Niche kuch real reviews hain jo users ne Google Play Store pe chhode, taaki tumhe sachchai ka andaza ho:

- Venky Naralasetty (20 Feb 2025): “Maine due amount time se pehle pay kiya, phir bhi unhone dobara paise kaat liye aur abhi bhi dikhata hai ki payment pending hai. Sabse badi problem—no customer care, no call support! Soch lo do baar loan lene se pehle.” 46 logon ne isse helpful bola.

Company Reply (22 Feb): “Sorry for the trouble, email loansupport@betterplace.co.in pe likho, jaldi solve karenge.” - Oli Rumi (7 Apr 2025): “Bohot kharab app, yeh Swiggy delivery boys ko target karta hai. Interest itna zyada—₹2000 ke loan pe 4 hafte mein ₹4000-5000 maangte hain. Delivery boys ko interest ka pata nahi hota, aur weekly salary se paise kaat lete hain.” 7 logon ne support kiya.

- Dilli Babu (10 Apr 2025): “Is baar Avanti Finance ke tie-up ne bohot bura experience diya. Maine payments time pe kiye, par unhone 4 hafte late mark kiya, jisse mera CIBIL score gir gaya. Waste of taking loan!” 3 log agree kiye.

- Shekhar Suman (29 Oct 2024): “Socha tha yeh app sach mein help karega, par yeh toh scam hai. Verification ke naam pe personal info le liya, par na loan mila, na paise. Bas time waste!” 115 logon ne isse helpful kaha.

Company Reply (30 Oct): “Sorry for the issue, loansupport@betterplace.co.in pe contact karo, hum help karenge.” - Hemanth Siragowni Shiva Kumar (9 Feb 2025): “Fraud app hai! Repay karne ke baad bhi late payment mark kiya, mera CIBIL score kharab ho gaya. Customer support kabhi jawab nahi deta—na email, na WhatsApp, na call. Please isse door raho!” 39 logon ne support kiya.

Company Reply (19 Feb): “We’re sorry, detailed feedback do taaki hum help kar sakein.” - Shaik Shashavali (8 Feb 2025): “Is app pe bharosa mat karo, yeh CIBIL kharab karta hai. Mera score 750 tha, time pe repay kiya par last 2 EMI update nahi kiye. Ab score 701 hai, aur ab mujhe loan nahi mil raha.”

Competitors Se Takkar

Agar compare karo apps like MoneyTap ya Kreditbee se, toh BetterPlace ka frontline workers pe focus unique hai. Par Moneyview jaise apps 10% se shuru hone wale interest rates aur ₹10 lakh tak ke loans dete hain, jo bada advantage hai. Plus, unka customer support aur CIBIL handling BetterPlace se behtar hai.

Safe Hai Ya Nahi?

BetterPlace Money RBI-approved NBFC Liquiloans ke saath kaam karta hai, jo isse legit banata hai. Data encryption bhi strong hai, aur 1.2 million active users ispe bharosa dikhate hain. Par customer support aur CIBIL ke issues iski reliability pe sawaal uthate hain.

Smart Borrowing Ke Tips

- Terms Samjho: Interest aur fees ka total hisaab laga lo. App ke sample loan example dekho.

- Time Pe Repay: Isse bade loans milenge aur CIBIL safe rahega.

- Limit Mein Raho: Baar-baar loan lene se bachho, warna dependency ban sakti hai.

- Options Dekho: Moneyview ya Bajaj Finserv jaise apps check karo, shayad better rates milein.

Final Verdict: Lene Ke Laayak Hai?

BetterPlace Money frontline workers ke liye ek tezi se paise dene wala tool hai, jo bina jhanjhat ke loan deta hai. Delivery boys aur gig workers ke liye iska Swiggy integration aur paperless process bada plus hai. Par high interest, CIBIL ke jhol, aur bekar customer support isse risky bhi banate hain. Agar tumhe urgent chhota loan chahiye aur terms clear hain, toh yeh kaam kar sakta hai. Par soch samajh ke kadam uthao, aur ho sake toh doosre apps bhi check karo.