Poonawala Fincorp Instant Personal Loan App Review 2025

The Poonawala Fincorp app is here to manage all your financial needs this application is trusted application and safe and secure your data you can apply for instant loan, personal loan, business loan, professional loan, medical equipment loan, loan against property and pre owned car loan with this app you can also check your CIBIL score using this poonawala Fincorp app.

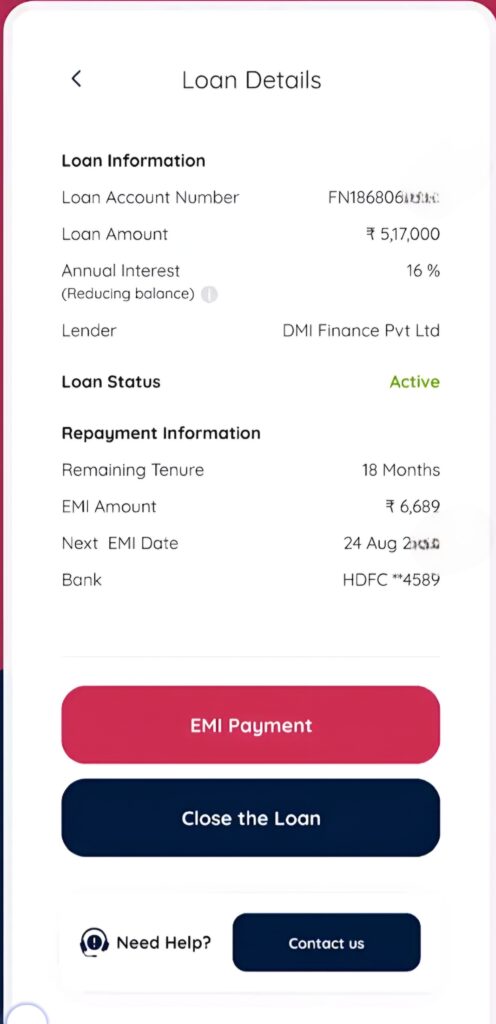

Instant personal loan

Poonawala Fincorp’s instant small personal loan is an extremely convenient product for a borrower who is looking for a quick small – ticket loan this loan is helpful for borrowers who need small financial assistance for achieving their immediate goals.

Highlights for instant personal loan

- Loan amount : rs. 50,000 to rs. 5 lakh

- Competitive interest rates starting from 16% to 36% APR varies from 20% to 40%

- Processing fee : 2.5% of sanction amount + GST

- 100% digital process

- Minimal documentation

- No collateral/security

- Flexible tenure : from 3 months to 36 months

- Quick Approvals

- Quick loan disbursal

- Easy process

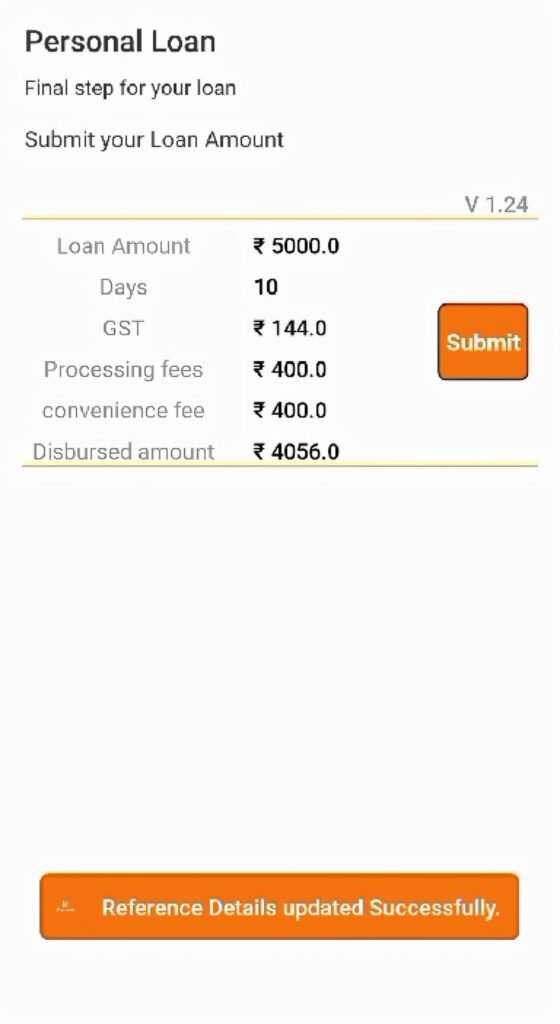

Example :

- Loan amount : 50,000

- Tenure : 12 months

- Interest charged : 4,441 (16% per annum)

- Processing fee : 1475 (2.5% of loan amount : 1250 + GST @18% : 225)

- APR : 24.6%

- Stamp duty : 100

- Broken period interest : 700

- Amount disbursed : 47,725

- EMI amount : 4,537

- Loan amount is 50,000 disbursed amount is 47,725 total loan repayment amount is 54,441

Example : Loan disbursement date : 14th July first EMI date : 5th September

Interest component to be calculated : 5th August to 5th September

BPI to be calculated from 14th July to 5th August

No. Of days for BPI 21

BPI account : 700

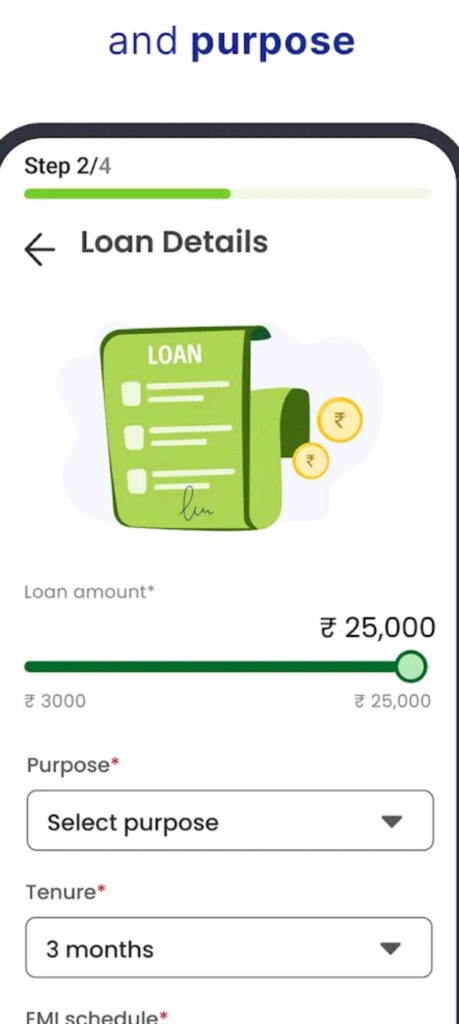

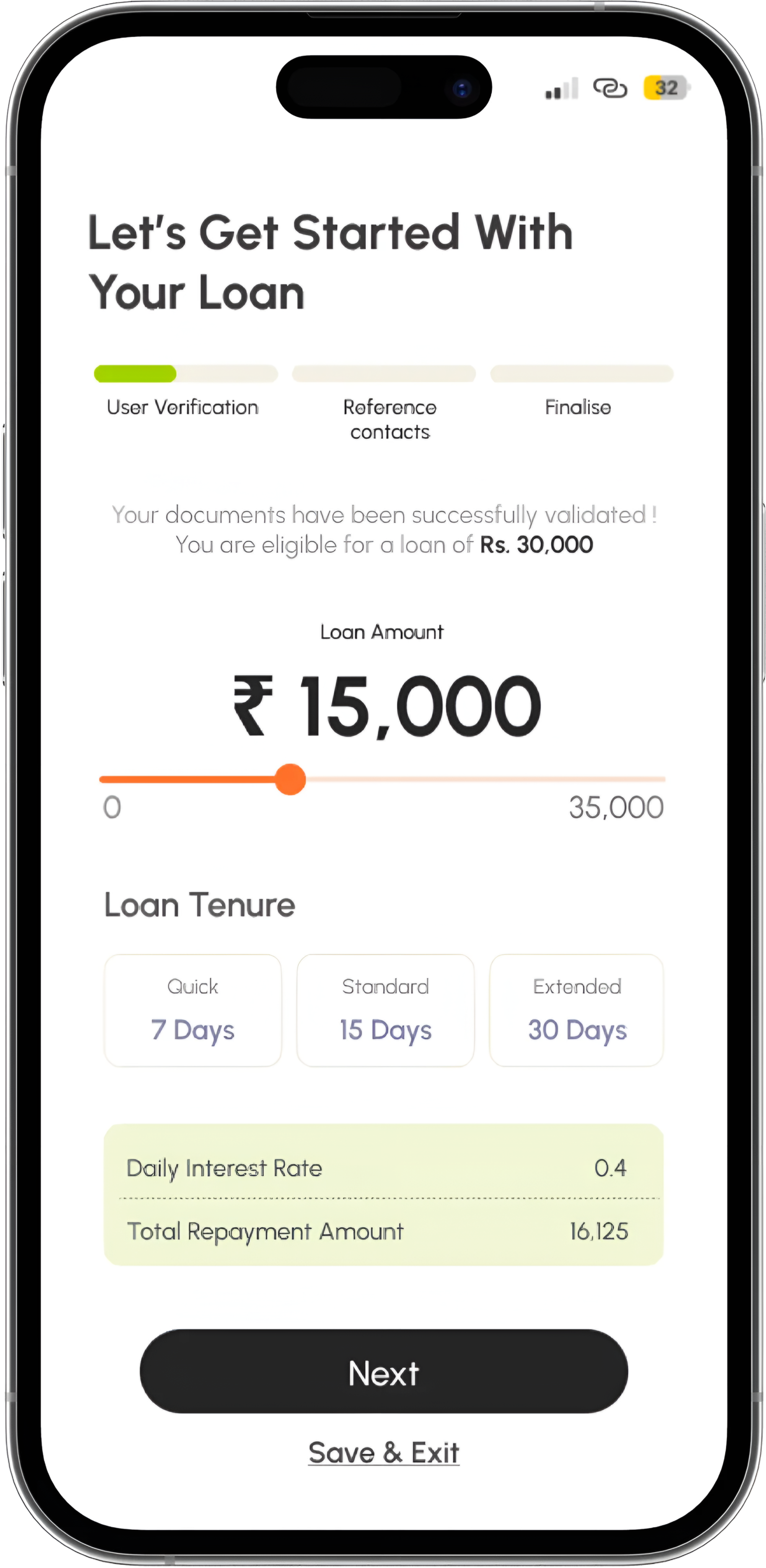

Personal loan

Apply for personal loan online up to rs. 30 lakhs whether you want to fund your medical bills without dipping into your savings or pay for your wedding expenses you can apply for a personal loan through our personal loan app.

Highlights for personal loan

- Loan amount up to 30 lakhs

- Competitive interest rates starting at 9.99% p.a.

- Processing fee : up to 2% plus taxes

- 100% digital process

- No collateral/Security

- Flexible tenure

- Minimum documentation

- Quick approvals

Business Loan

Empower your business and take it to new heights with Poonawala Fincorp fast and hassle free loan app you can boost working capital buy new business equipment and expand your workforce with poonawala Fincorp apps

Highlights for business loan

- Loan amount up to 50 lakhs

- Competitive interest rates starting at 15% p.a.

- Processing fee : up to 3% of sanction amount plus taxes

- 100 digital process

- No collateral/security

- No hidden charges

- Minimal documentation

Professional Loan

Poonawala Fincorp offers a wide range of benefits and features in professional loan you can expand your practice enhance your professional skills and renovate your office space with poonawala ‘s professional loan

Highlights for professional loan

- Multi – purposes sanction up to 50 lakhs

- Competitive professional loan interest rate starting at 9.99% p.a.

- Processing fee : up to 2% of sanctioned amount plus taxes

- No prepayment and foreclosure penalty if paid from own sources

- Collateral free loans for professionals

- Flexible tenure ranging up to 60 months

Pre – owned car loan

- Loan up to rs.75 lakhs

- Interest rate starting at 11% p.a.

- Processing fee : 1% of sanction amount plus taxes

- Loan up to 100% of car value

- Flexible repayment options loan against property

- High LTV for ample funding ranging up to 10 crore

- Competitive interest rate starting at 9% p.a.

- Processing fee: up to 1% of sanctioned amount + GST

- Wide range of properties accepted as collateral

- Long and flexible tenure up to 15 years

- Quick and easy approval process

Medical Equipment Loan

- Higher loan amount of up to 10 crore

- Competitive interest rates starting at 9.99% p.a.

- Up to 1% of sanction amount + GST

- Longer repayment tenure of up to 84 months

- No hidden charges

We have taken all security measures for your privacy and safety in case of queries please reach out to “Customercare@poonawalafincorp.com”