3 New Personal Loan App For Everyone 2025 : 0 Cibil Loan

New personal loan app makes it easy to get an instant personal loan of up to 10 lakhs in just 15 minutes right from your mobile phone skip the long queues with New Personal Loan App one of India’s top – rated loan app, where you can secure a loan for emergency expenses unexpected bills or that dream vacation.

Top Features Of The New Personal Loan App :

- Free Eligibility check : check your loan eligibility instantly with Incred loan hassle – free

- Real time loan tracking – track your loan application status in real time using our loan app which provide you with instant updates on your new personal loan application.

- 100% online KYC process : our RBI registered loan app ensures a secure fast and completely digital online instant loan app experience for you.

- Dedicated support : a relationship manager helps you every step of the way making the process easier with our instant finance options and personalized assistance

- EMI reminders & schedule : recieve automated reminders for your EMIs and easily access your repayment schedule via the New Personal Loan App platform offering a seamless loan mobile app experience

Why Choose New Personal Loan App ?

- Instant loan approval in 5 minutes

- 100% online application process

- No collateral required

- Competitive interest rates : starting from 13.99% p.a.

- Flexible repayment terms : 6 to 60 months

- Customised loan amount & tenure : manage your EMIs with ease

- Simple EMI deduction via eNACH

Quick loan breakdown example : Mr. Rohan needs an urgent loan of 1,00,000 he applied for the same through the new personal loan app which was approved within minutes here’s how it worked :

- Sanctioned loan amount : 1,00,000

- Processing fee : 3,540

- Net disbursed amount : 96,450

- Interest rate : 21% per annum

- Monthly EMI : 3,767.5

- Total repayment : 1,35,630

- Total loan cost : 39,170

Note : This is just an example the final APR for your loan will be as per your credit assessment annual percentage Rate range for Incred personal loan is 16% to 60%

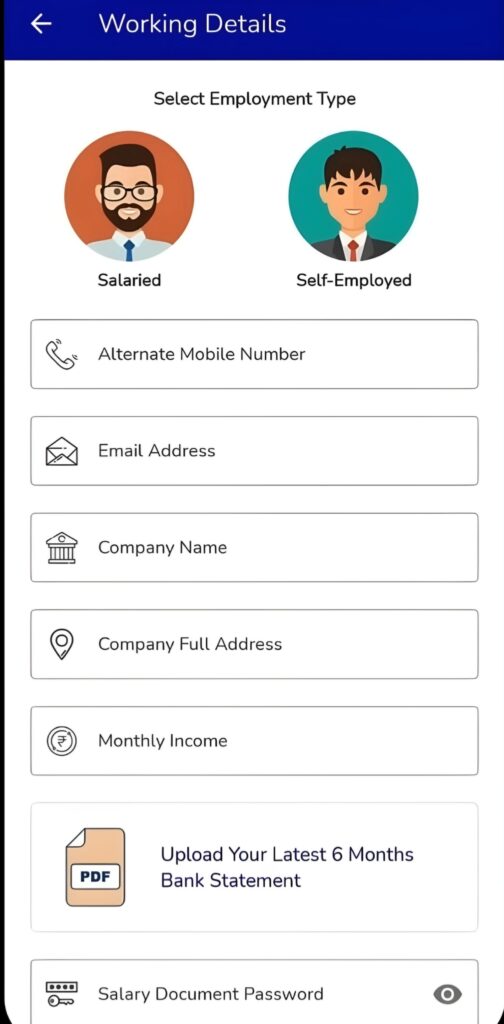

Who can apply ?

- Age requirment : 21 to 55 years

- Minimum monthly salary : 15,000 for Salaried Individuals or 25,000 for business owners with ITR and GST documents

- Credit score : preferably 700+ with a solid repayment history

What you can use an new personal loan app for ?

- Marrige and wedding expenses

- Travel and vacations

- Appliances and gadgets

- Education courses and upskilling

- Medical emergencies

- Home renovation

- Credit card bills

- Buying a new phone or bike

New Personal Loan App also offers education and business loans tailored for students and marchants learn more by visiting our website at www.newloanapp.com.

Trusted and secure lending – New Personal Loan App is a registered RBI complaint loan app with a strong commitment to responsible Lending compliance with thousands of borrowers and merchant supported new loan app provides dependable and secure financing to help meet your financial goals.

400,000 + happy borrower’s

18,000cr + disbursed in personal loan

8,000 + students financed

For queries us at : https://wa.me/ + 918826272192