10 Best Personal Loan Apps Without Income Proof 2025

Life is full of surprises, and not all of them are pleasant. Whether it’s a medical emergency, urgent home repair, or an unexpected expense, sometimes you need funds fast—even if you lack traditional income proof. Freelancers, gig workers, or those with irregular income often face hurdles when applying for loans. Fortunately, several digital lending platforms now offer personal loans without requiring salary slips or formal income documents. Here’s a curated list of the **10 best personal loan apps without income proof 2025 ** to help you bridge the gap during crunch times.

Why Opt for Loan Apps Without Income Proof?

Traditional lenders rely heavily on salary slips and employment verification, leaving self-employed individuals or cash-earners in a bind. Modern fintech apps, however, use alternative data—like bank statements, credit behavior, or even social profiles—to assess eligibility. Benefits include:

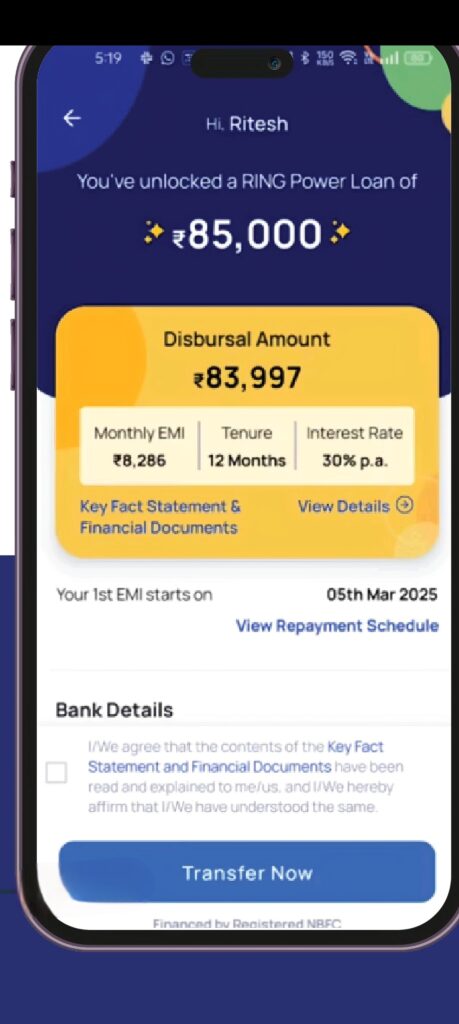

✅Ring Power Personal Loan

- Key Features: Offers a credit line up to ₹5 lakh. Uses bank statements and credit scores for approval.

- Interest Rate: 1.08% per month onward.

- Tenure: Up to 36 months.

- Eligibility: Salaried or self-employed with a bank account.

2. KreditBee

“Use Code” DSA100

For 100% Off in Processing fee

- Key Features: Loans up to ₹4 lakh for salaried and self-employed individuals. Analyzes alternate data like education and employment history.

- Interest Rate: Starts at 0.9% per month.

- Tenure: 2–15 months.

- Eligibility: Ages 21–50 with a bank account.

3. Olyv ( SmartCoin) Online

- Key Features: Instant loans up to ₹4 lakh using AI-driven checks on social profiles and SMS bank data.

- Interest Rate: 2.5% monthly (30% APR).

- Tenure: Up to 18 months.

- Eligibility: Salaried professionals aged 25+ with a minimum ₹15,000 monthly income.

4. Fibe : Best Personal Loan

- Key Features: Loans up to ₹5 lakh. Considers bank transaction history for freelancers.

- Interest Rate: 0.9–2.4% per month.

- Tenure: 3–24 months.

- Eligibility: Must have a bank account with 3+ months of transaction history.

5. PaySense

- Key Features: Disburses up to ₹5 lakh using bank statements and credit history.

- Interest Rate: 1.4–2.5% per month.

- Tenure: 3–36 months.

- Eligibility: Ages 21–60 with a stable income source.

6. Navi Loan App

- Key Features: Offers loans up to ₹20 lakh. Uses health records and spending habits for assessment.

- Interest Rate: Starts at 1.5% per month.

- Tenure: Up to 24 months.

- Eligibility: Requires a credit score of 650+

7. Nira

- Key Features: Small-ticket loans (up to ₹1 lakh) via bank account analysis.

- Interest Rate: 1.5–2.5% per month.

- Tenure: 3–12 months.

- Eligibility: Ages 22–55 with a monthly income of ₹15,000+.

8. Olyv(Formerly Smartcoin)

- Key Features: Loans up to ₹5 lakh based on bank transaction patterns.

- Interest Rate: 1.5–2.5% per month.

- Tenure: 3–36 months.

- Eligibility: Bank account with 6+ months of activity.

9. mPokket

- Key Features: Targets students and young professionals. Loans up to ₹45,000 with minimal docs.

- Interest Rate: 0–4% processing fee.

- Tenure: 1–3 months.

- Eligibility: Ages 18–35 with a college ID or part-time job.

10. LoanFront

- Key Features: Fast approval (15 minutes) for loans up to ₹2 lakh. Uses bank statements for verification.

- Interest Rate: 2–3% per month.

- Tenure: 3–12 months.

- Eligibility: Monthly income of ₹12,000+.

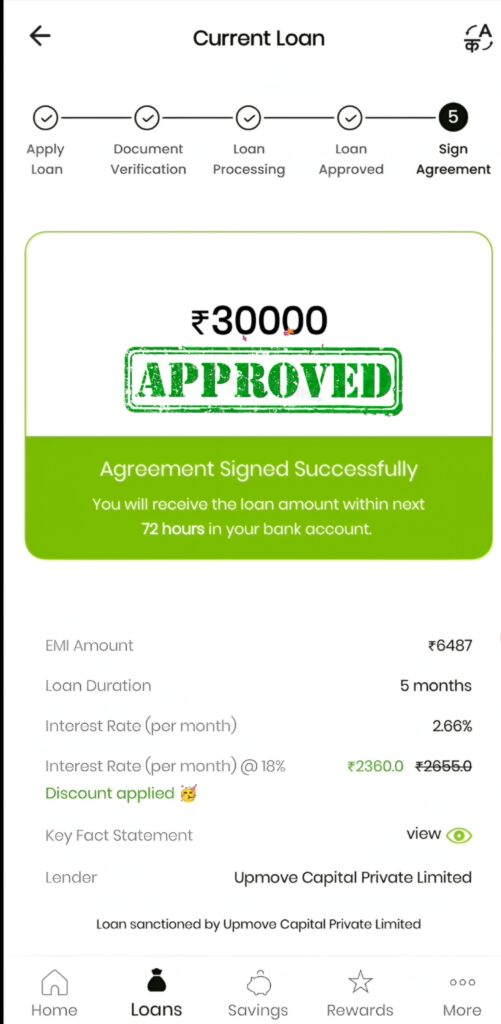

Things to Consider Before Applying

- Interest Rates: These loans often have higher rates than traditional options. Compare APRs.

- Hidden Charges: Check processing fees, prepayment penalties, or late fees.

- Repayment Tenure: Ensure the EMI fits your budget.

- App Credibility: Read reviews and confirm the app is RBI-compliant (for India).