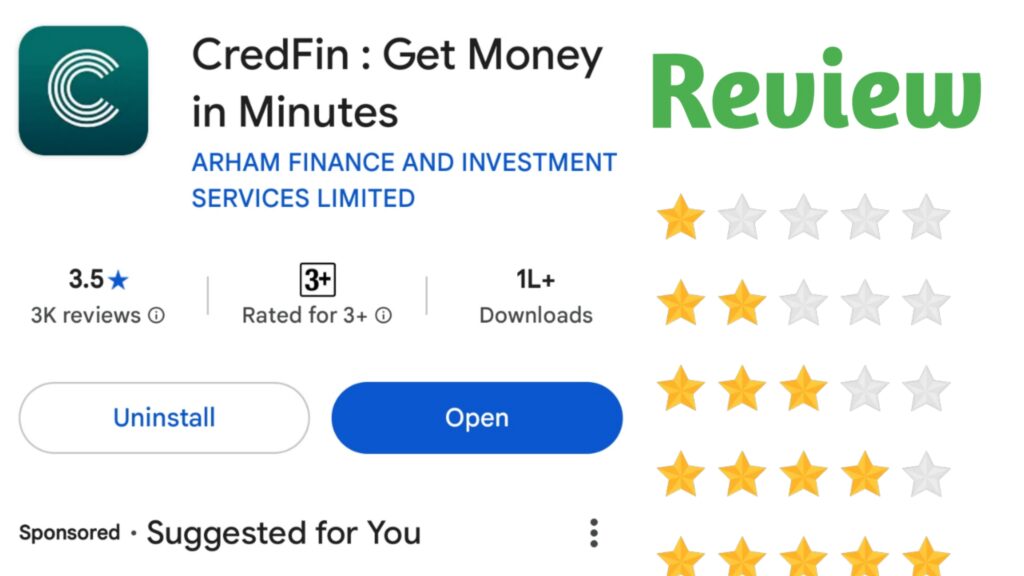

CredFin Loan App Review : CredFin Loan App 2025

Quick and Accessible Financial Solutions for Your Needs!

Credfin: Smart Lending for a Better Financial Future

At Credfin, we understand the importance of quick and accessible financial solutions tailored to your needs. Our app is thoughtfully designed to deliver just that. With a user-friendly interface and advanced features, you can secure the funds you require in no time. Our app is compatible with multiple platforms, ensuring seamless access whether you’re using it on the web or your mobile device—anytime, anywhere.

We’ve incorporated the key attributes that users like you expect from a loan app: convenience, speed, and robust data protection. This ensures a smooth, secure, and hassle-free borrowing experience.

Key Features of credfin

No Security Deposit

No Hidden Costs

● Loan Amount: ₹5,000 to ₹2 Lakhs

● Loan Tenure: 62 days to 365 days

● Annual Percentage Rate (APR): 0% – 36%

● 100% Digital Process: Completely paperless and efficient

● Accessible Anytime, Anywhere: Available at your fingertips via our mobile app or web platform

● Minimal Documentation: Simplified process with fewer paperwork requirements

● Instant Approvals: Completed applications are approved instantly, addressing your financial needs promptly

● Direct Money Transfer: Funds are transferred directly to your bank account upon approval

● Transparent Terms: Clear and straightforward conditions for a worry-free experience

Why Choose Us?

- User-Friendly Interface: Easy navigation for a seamless experience

- Security and Data Protection: Your information is safe with us

- Easy Repayments: Flexible options to suit your convenience

- Direct Disbursement: Quick access to funds without delays

- Quick Approval: Fast processing to meet urgent needs

Eligibility Criteria

- Salaried individuals

- Age above 21 years

- Minimum take-home salary of ₹15,000 per month

Required Documentation

- PAN Card

- Aadhaar Card

- Salary account bank statement

Sample Calculation

Loan Amount: ₹20,000

Tenure: 3 Months

Interest: Flat 36% per annum

Processing Fees (incl. GST): ₹708

Disbursed Amount: ₹20,000 – ₹708 = ₹19,292

Flat Interest: ₹20,000 × 3/12 × 36% = ₹1,800

Total Repayment Amount: ₹20,000 + ₹1,800 = ₹21,800

Monthly EMI: ₹21,800 / 3 = ₹7,267

Total Cost of Loan: Interest Amount + Processing Fees = ₹1,800 + ₹708 = ₹2,508

Interest Rates and Other Charges

Interest Rate: 0% to 36%

Late Payment Charges: Up to 8.33% per month on the overdue amount (minimum ₹500 + GST)

Mandate Reject Charge: ₹250 + GST

Bounce Charges: ₹500 + GST

Prepayment Charges: Nil

Processing Fees (incl. GST): ₹590 to ₹11,918 (varies based on loan amount and tenure)

Approval Process

- Log in to the Credfin app.

- Fill in basic details and upload the required documents.

- Select your desired loan amount and tenure.

- Receive the funds directly in your bank account.

Safety & Security

● SMS: We analyze your SMS to assess creditworthiness and determine your loan offer.

● Device Info: Links the loan application securely to your phone.

● Location: Ensures serviceability and speeds up the KYC process.

● Camera & Media Access: Allows you to upload a selfie during the application process.

For more details on our policies regarding dues, visit our official website.

Our Partner

Credfin collaborates with an RBI-compliant NBFC:

Arham Finance & Investment Services Ltd.

Contact Us

For any assistance or queries, feel free to reach out to us at:

Email: developer@arhamfinance.com

With Credfin, managing your financial needs has never been easier. Download the app today and experience a smarter way to borrow!

Let me know if you’d like any adjustments!