2025 ka Sabse Zabardast Personal Loan App: Bina Income Proof aur Cibil Score ke Milega Instant Loan!

Aaj ke time mein paisa har kisi ke sapno ka ek bada hissa ban chuka hai. Chahe baat ho ek nayi dukaan kholne ki, medical emergency ka kharcha uthane ki, ya phir apne dream vacation ke liye saving karne ki, paise ke bina har plan adhura sa lagta hai. Lekin kya karein jab bank aur traditional lenders aapko loan dene se mana kar dein, kyunki aapke paas income proof nahi hai ya Cibil score kam hai? Yahan tak ki agar aapka Cibil score bilkul zero ya “Not Available” hai, toh banks toh aapko dekhte hi darwaza band kar dete hain! Par tension lene ki zarurat nahi, kyunki 2025 ek aisa loan app leke aaya hai jo aapki life ko ekdum badal sakta hai—wo bhi bina kisi income proof ya Cibil score ke! Is article mein hum aapko ek aise magical app ke baare mein batayenge jo aapki financial problems ko chhutki mein solve kar sakta hai. Lekin iska naam? Woh toh hum bilkul last mein reveal karenge, thodi si curiosity toh banta hai!

Bina Cibil aur Income Proof ke Loan: Sach ya Jhooth?

Agar aap soch rahe hain ki bina Cibil score aur income proof ke loan milna impossible hai, toh aap ekdum galat hain! 2025 mein technology ne financial world ko ek nayi disha di hai. Ab woh purane zamane ke tareeke nahin chalein jab aapko bank mein line lagani padti thi, dher saare documents dikhane padte the, aur phir bhi loan reject ho jata tha. Aaj ke digital loan apps ne rules hi badal diye hain. Ye apps Cibil score ko bypass karte hain aur aapki creditworthiness ko naye tareeke se check karte hain.

Toh yeh apps aapko loan ke liye eligible kaise maante hain? Iske peeche hai alternative data ka kamaal! Ye apps aapke bank account ke transactions, online shopping history, mobile bill payments, aur kabhi-kabhi toh aapke social media activity ko bhi dekhte hain. Agar aap apne utility bills ya phone recharge time pe karte hain, ya aapke bank account mein regular transactions dikhte hain, toh yeh apps aapko loan dene ke liye taiyaar ho jate hain. Aur sabse badi baat? Yeh process itna fast hai ki aap apni coffee pee rahe ho aur uske khatam hone se pehle aapka loan approve ho sakta hai!

2025 mein Is App ke Kya Hain Features?

Yeh naya loan app 2025 mein apne unique features ke wajah se sabka dil jeet raha hai. Aaiye dekhte hain iski kuch khas baatein:

- Instant Approval: Bas 5-10 minute mein aapka loan approve! Na koi lambi paperwork, na hi ghanto ka intezar.

- Minimum Documents: Sirf Aadhaar card, PAN card, aur ek selfie—bas yahi chahiye. Na koi salary slip, na ITR.

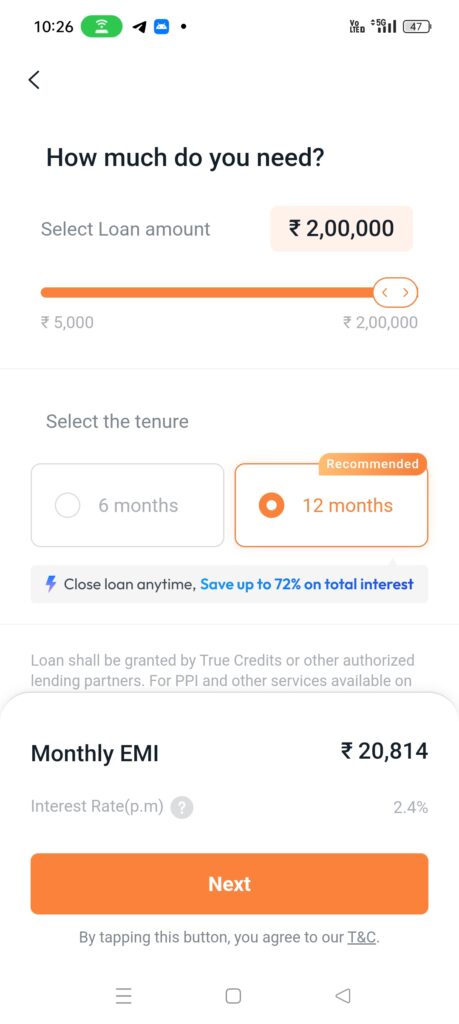

- Flexible Loan Amount: Aap 5,000 se lekar 1.25 lakh tak ka loan le sakte hain, aur repayment tenure 3 se 12 mahine tak choose kar sakte hain.

- No Cibil Check: Chahe aapka Cibil score 300 ho, -1 ho, ya bilkul na ho, is app ko koi farak nahi padta. Yeh aapki current financial habits pe focus karta hai.

- 24/7 Access: Subah 6 baje ya raat ke 3 baje, jab bhi aapko paiso ki zarurat ho, yeh app hamesha ready hai.

- Transparent Terms: Koi chhupa hua charge nahi. Interest rates 2.4% per month se shuru hote hain, aur saari conditions pehle hi clear kar di jati hain.

- User-Friendly Interface: App itna simple hai ki ekdum naye smartphone user bhi ise aasani se use kar sakte hain.

Kaise Kaam Karta Hai Yeh App?

Yeh app ek high-tech algorithm ka use karta hai jo aapki financial stability ko judge karta hai. Traditional banks Cibil score aur income proof pe depend karte hain, lekin yeh app alag hai. Iske liye aapke daily transactions, bill payments, aur banking habits kaafi hain. For example, agar aap apne phone ka bill ya electricity bill time pe pay karte hain, toh yeh app samajh jata hai ki aap responsible ho aur loan repay kar sakte ho.

Iske alawa, yeh app RBI-registered NBFCs ke saath partnership mein kaam karta hai, jo iski credibility ko aur badhata hai. Yani aapka data safe hai aur aap kisi fraud ka shikar nahi honge. Aur toh aur, is app ka approval rate bhi kaafi high hai, kyunki yeh chhote aur medium loans pe focus karta hai, jo aam aadmi ke liye perfect hain.

Kya Hain Iske Fayde?

Is app ke itne saare benefits hain ki aap hairan reh jayenge:

- Newbies ke liye Perfect: Agar aapne kabhi loan nahi liya ya aapka Cibil score nahi hai, toh yeh app aapke liye ek golden opportunity hai.

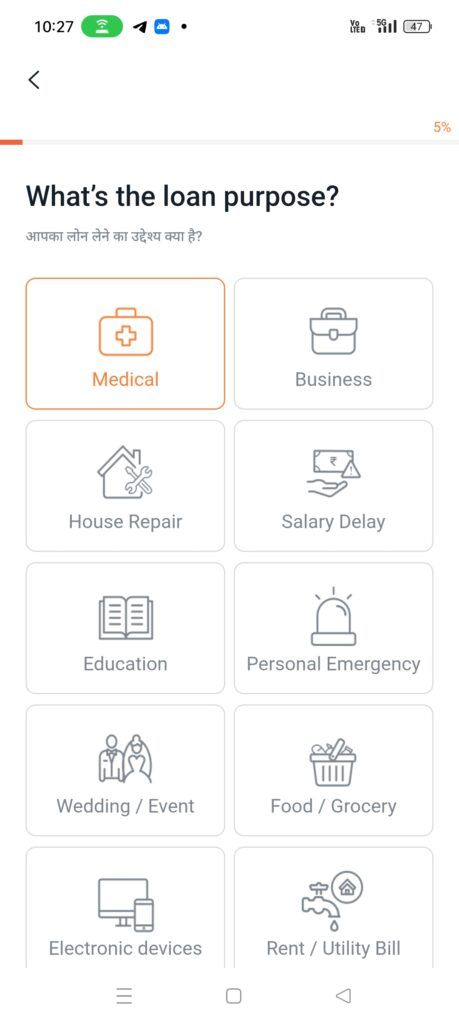

- Emergency ke liye Best: Medical bills, urgent repairs, ya last-minute travel—yeh app har situation mein kaam aata hai.

- Credit Score Build Karo: Agar aap apne EMIs time pe pay karte ho, toh yeh app aapka credit score improve karne mein bhi madad karta hai.

- No Middleman: Direct app se loan milta hai, toh koi agent ya broker ke chakkar mein nahi padna.

- Small Businesses ke liye Vardan: Agar aap ek chhota sa business shuru karna chahte ho, toh yeh app aapko initial funding de sakta hai.

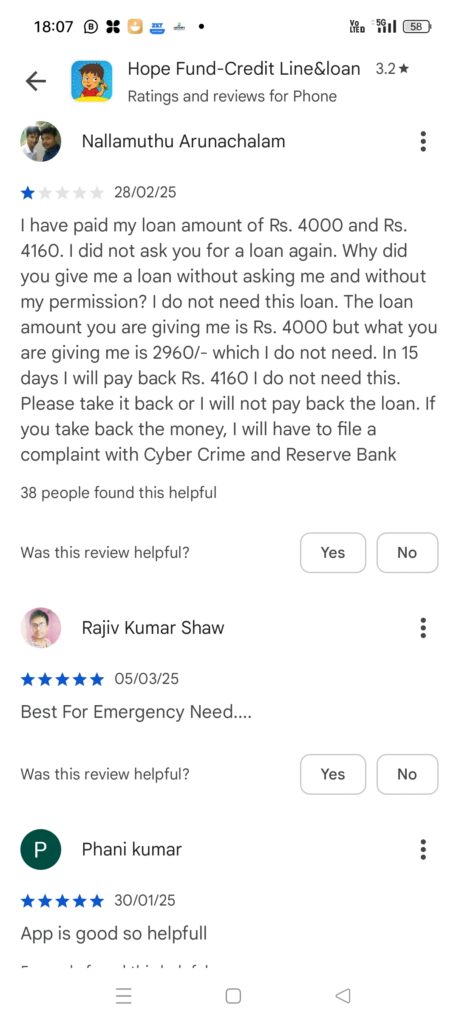

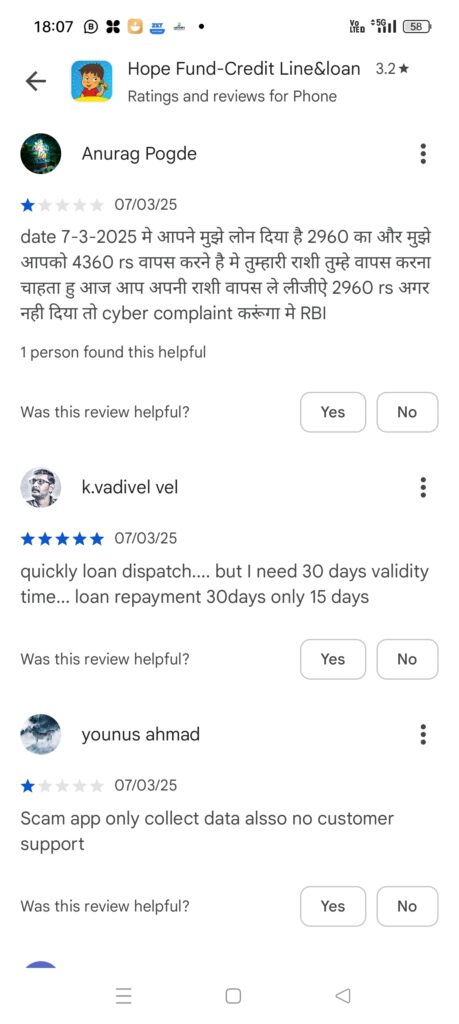

Lekin Thodi Si Savdhani Bhi Zaruri Hai!

Har cheez ke saath thodi si responsibility bhi aati hai, aur yeh loan app bhi isse alag nahi. Bina Cibil aur income proof ke loan milna ek badi suvidha hai, lekin iske kuch risks bhi hain:

- High Interest Rates: Banks ke comparison mein in apps ke interest rates thode high hote hain—18% se 54% per year tak. Isliye hamesha apni repayment capacity check karein.

- Penalty Charges: Agar aap EMI time pe nahi chukate, toh late fees aur penalties lag sakti hain, jo aapke budget ko bigaad sakti hain.

- Data Privacy: Hamesha check karein ki app RBI-approved NBFC ke saath kaam karta ho, warna aapka personal data misuse ho sakta hai.

- Over-Borrowing: Zyada loan lene ka lobh na karein. Sirf utna hi loan lein jitna aap asani se repay kar sakte ho.

Kaun Use Kar Sakta Hai Yeh App?

Yeh app almost har kisi ke liye hai, lekin kuch basic requirements hain:

- Aapki age 21 se 59 saal ke beech honi chahiye.

- Aapke paas valid Aadhaar aur PAN card hona chahiye.

- Ek active bank account aur mobile number zaroori hai.

- Indian citizen hona chahiye.

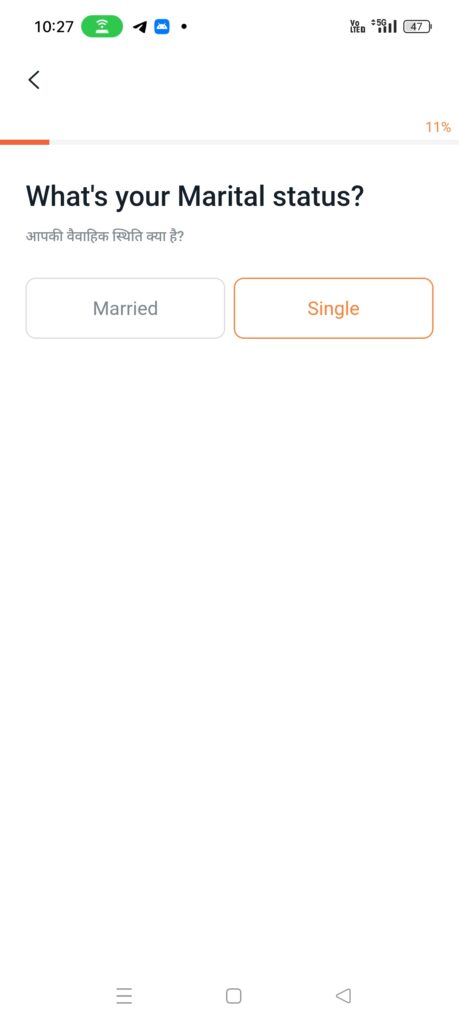

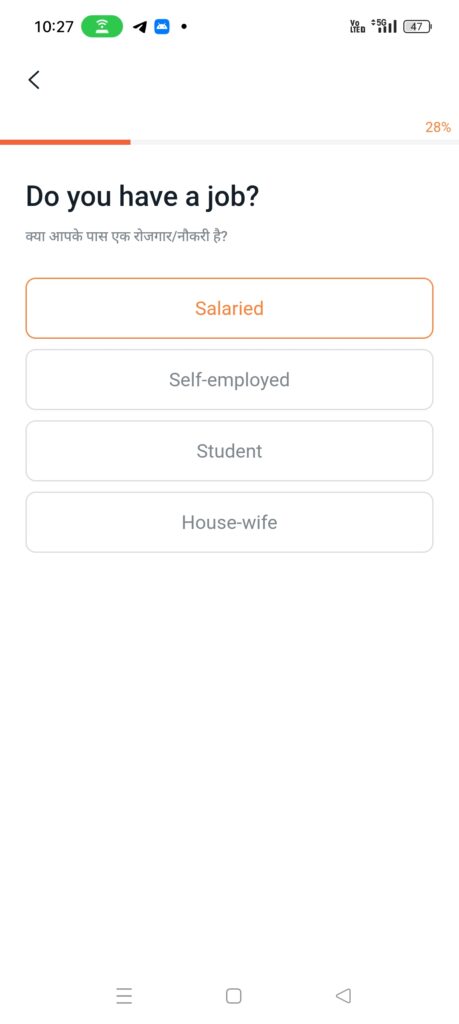

Is app ka sabse bada plus point yeh hai ki yeh students, freelancers, small business owners, aur even housewives ke liye bhi perfect hai. Chahe aapka koi fixed income source na ho, yeh app aapko financially empower karta hai.

Kaise Apply Kare? Step-by-Step Guide

Ab aaiye jante hain ki is app se loan lene ka process kya hai. Yeh itna simple hai ki aap ghar baithe, apne phone se sab kuch kar sakte hain:

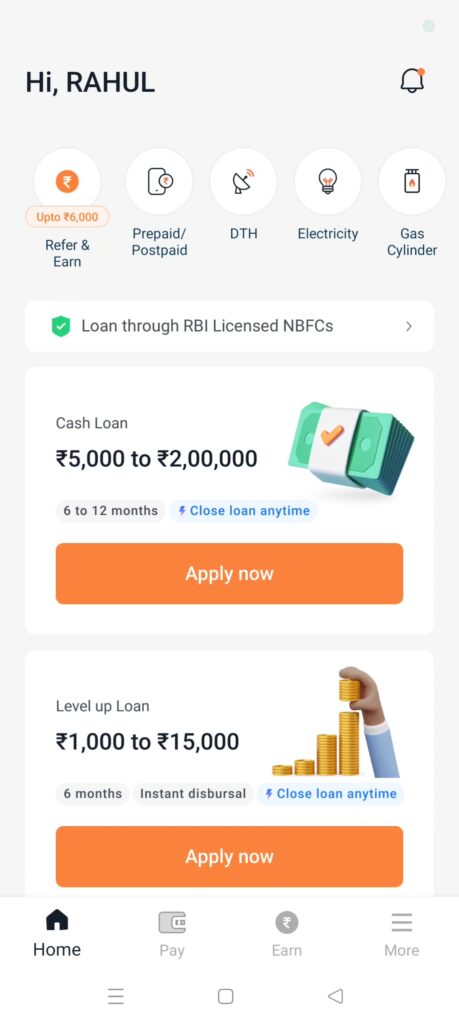

- App Download Karein: Google Play Store ya App Store se app download karein.

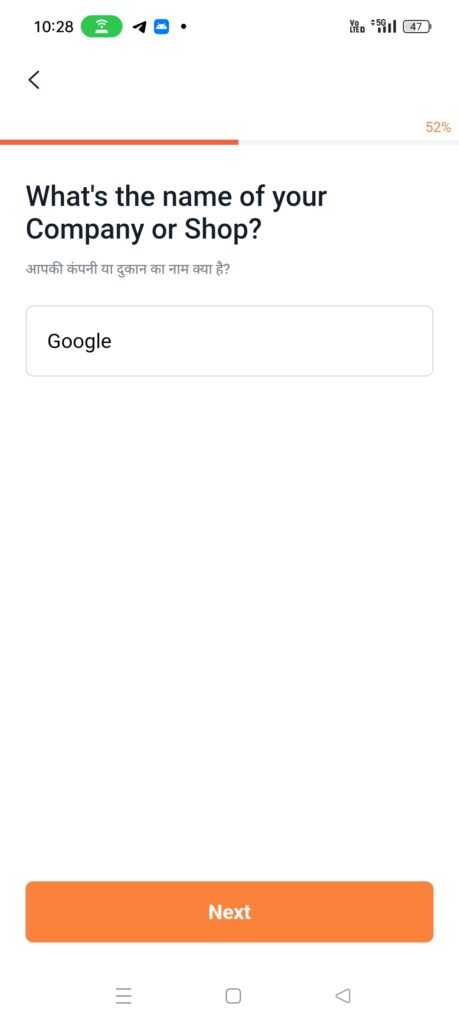

- Sign Up Karein: Apne mobile number aur email ID se register karein. Ek OTP ke through verify karna hoga.

- KYC Complete Karein: Aadhaar card, PAN card, aur ek selfie upload karein. Aadhaar-linked OTP se verification ho jayega.

- Loan Offer Dekhein: App aapke bank details aur alternative data ke basis pe aapko loan offers dikhayega. Aap apni zarurat ke hisaab se amount aur tenure select karein.

- Paisa Prapt Karein: Loan approve hone ke baad paisa direct aapke bank account mein transfer ho jayega—kabhi kabhi toh 15-30 minute ke andar!

Real-Life Examples

Chaliye, kuch real-life scenarios dekhte hain jahan yeh app kaam aa sakta hai:

- Rohan, ek Freelancer: Rohan ek graphic designer hai jisko ek naye laptop ki zarurat thi. Lekin uska Cibil score nahi tha aur banks ne uska loan reject kar diya. Is app ke through usne 50,000 ka loan liya aur apna business grow kiya.

- Priya, ek Student: Priya ko apne college fees ke liye 20,000 ki zarurat thi. Uske paas koi job nahi thi, lekin is app ne uske regular phone bill payments ke basis pe loan diya.

- Amit, ek Shopkeeper: Amit ko apni dukaan ke liye extra stock kharidna tha. Is app se usne 80,000 ka loan liya aur apna business double kar liya.

Yeh App Kyun Hai Sabse Alag?

Yeh app na sirf loan deta hai, balki aapki financial journey ko empower karta hai. Iska focus hai un logon pe jo traditional banking system se bahar reh jate hain. Students, new entrepreneurs, ya woh log jo abhi credit world mein naye hain, sabke liye yeh ek game-changer hai. Plus, iska user-friendly design aur quick response time ise har age group ke liye perfect banata hai.

Iske alawa, yeh app aapko financial discipline sikhata hai. Agar aap apne EMIs time pe pay karte hain, toh aapka credit score bhi improve hota hai, jo future mein bade loans ke liye kaam aata hai. Yani yeh app na sirf aaj ke liye hai, balki aapke kal ko bhi better banata hai.

Toh Kya Hai Is App ka Naam?

Ab suspense khatam karne ka time aa gaya hai! Yeh revolutionary loan app hai—True Balance! Ji haan, True Balance ek aisa digital lending platform hai jo RBI-registered NBFCs ke saath kaam karta hai aur bina Cibil score ya income proof ke loans deta hai. Iska simple interface, fast processing, aur transparent policies ne ise 2025 mein India ka favorite loan app bana diya hai.

Last Mein Ek Advice

True Balance jaise apps aapki life ko asaan bana sakte hain, lekin hamesha smartly borrow karein. Loan lene se pehle app ki terms and conditions dhyan se padhein. Interest rates, processing fees, aur repayment schedule ko samajh lein. Aur sabse badi baat, sirf utna hi loan lein jitna aap asani se repay kar sakte ho. Financial freedom pane ka yeh ek shandaar tareeka hai, bas thodi si planning ke saath!

Toh ab wait kis baat ka? True Balance abhi download karein aur apne sapno ko hakikat mein badle. Lekin yaad rakhein—loan lena ek badi zimmedari hai. Apne budget ka dhyan rakhein aur hamesha RBI-approved platforms ka hi use karein.

Disclaimer: Loan lene se pehle True Balance ki official website ya app pe saari details check karein. Interest rates aur charges aapke loan amount aur profile ke hisaab se alag-alag ho sakte hain. Hamesha safe aur verified platforms ka use karein.