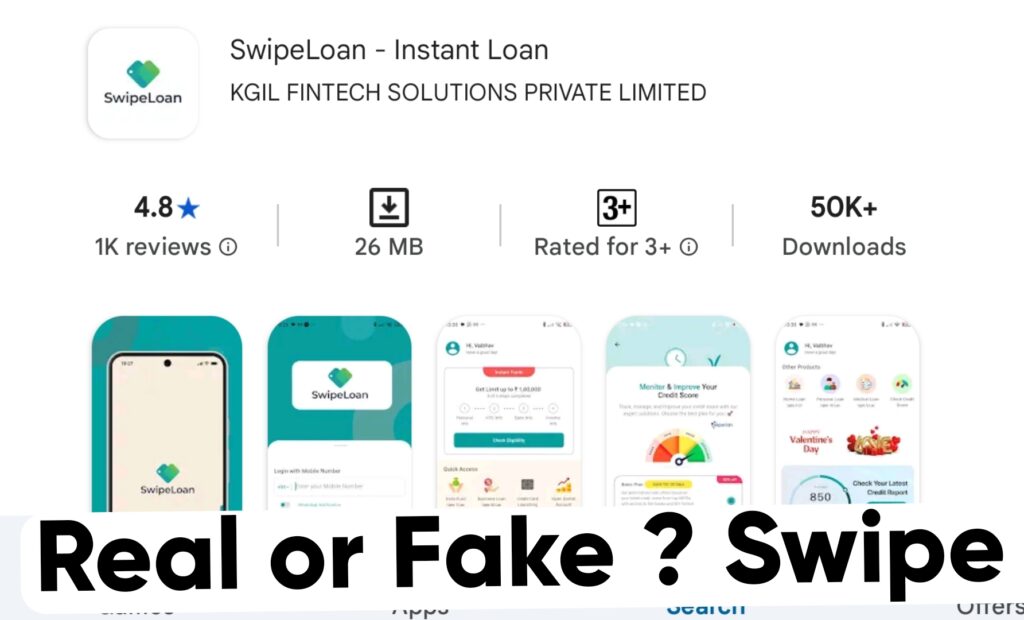

SwipeLoan Loan Review : क्या ये ऐप फर्जी है?

SwipeLoan ek online “loan facilitator” platform hai jo users ko minutes mein instant credit provide karta hai. Yeh Salora Capital Ltd aur NSMK INVESTMENTS PVT LTD ka loan product hai, dono RBI ke under registered NBFCs hain. Abhi full loan application process development mein hai, lekin hum aapko hamare current services aur features ke baare mein batane ke liye excited hain, jo future updates mein aur bhi expand honge.

Table of Contents

Key Features (Swipe Loan)

- KYC Verification: Apne KYC process ko easily complete karein by uploading ID proof, address proof, aur PAN card. Yeh feature abhi active hai.

- Credit Score Check: Loan apply karne se pehle apna credit score check karein.

- DMAT Account Opening: Internal web URL ke through DMAT account banayein.

- Business Loan Application: Business loan ke liye internal web URL se apply karein.

- Insta Fund: Click karein aur available NBFCs dekhein, phir unmein apply karein.

Note: Loan application, disbursal, aur repayment features jald hi launch honge. Updates ke liye bane rahiye!

Swipe App Fees and Charges

- Loan Amount: ₹5000 se ₹50000 tak

- Minimum Loan Tenure: 91 days

- Maximum Loan Tenure: 365 days

- Maximum APR: 35% per annum

- Processing Fee: ₹500 se ₹5000 (tenure aur amount ke hisaab se)

- GST: Processing fee pe 18% (Indian law ke mutabik)

Kyun Na Choose Karein Swipe Loan?

- Very High Interest Interest Rates: high Competitive rates pe affordable loans.

- Low Processing: Online apply karein aur 1 hour mein paisa bank mein payein.

- Easy Repayment: Flexible repayment options. 100% Paperless: Koi physical documents ki zarurat nahi.

- No Safe & Secure: ये आपका कॉन्टैक्ट का डेटा चुराती है Aapka data secure hai aur process transparent hai.

- Collateral Free: Loan ke liye koi guarantee nahi chahiye.

क्या हमें Swipe app से लोन चाहिए ?

इस लोन ऐप से आपको बिल्कुल भी लोन नहीं लेना चाहिए क्योंकि एक लोन ऐप पूरी तरह से फर्जी है क्योंकि ये आपका डेटा ले कर आपको परेशान कर सकती है और आपको केवल 7 दिन का लोन देती है इसलिए मैं कभी नहीं चाहूंगा कि आप इस लोन ऐप से लोन ले आपको इससे अच्छी लोन ऐप मैं बताऊंगा जिससे आप 5000₹ से 2 लाख का लोन तुरंत ले सकते है

Eligibility Criteria swipe loan app

- Aapko Indian national hona chahiye.

- Umar 21 se zyada honi chahiye.

- Steady monthly income honi chahiye.

- Annual household income ₹3,00,000 se zyada honi chahiye (sabhi sources se). “Household” ka matlab hai ek family unit – husband, wife, aur unmarried children jo 21 se bade hain.

FAQ: Frequently Asked Question?

- Swipe Loan app real or fake

- Is Swipe Loan app legit

- Swipe Loan app review

- Swipe Loan app scam or genuine

- Swipe Loan app trustworthy

- Swipe Loan app authenticity

- Swipe Loan app safe or not

- Swipe Loan loan app fraud

- Swipe Loan app verification

- Swipe Loan app reliability

- Is Swipe Loan app real or fake in India

- Swipe Loan app real user reviews

- How to check if Swipe Loan app is legit

- Swipe Loan app scam complaints

- Swipe Loan instant loan app genuine or fake

- Swipe Loan NBFC registration

- Swipe Loan app KYC process

- Swipe Loan loan app interest rates

- Swipe Loan app customer reviews

- Swipe loan app security

- can I trust SwipeLoan app? Is

- Swipe Loan app approved by RBI?

- Does Swipe Loan app really give loans?

- Is Swipe Loan app a scam app?

- How safe is Swipe Loan app for loans?

- Swipe Loan app sach ya jhooth

- Swipe Loan app safe hai ya nahi

- SwipeLoan app asli ya nakli

- Swipe Loan loan app real ya fake

- Swipe Loan app par bharosa kar sakte hain?