Urgent Cash loan without documents

If You Wanna take Urgent Cash loan without Documents You are in Right place Because Today We will Give best Urgent Cash loan app Which gives loan upto 50,000 instantly in Your Bank Account Even You Don’t Need To Give Income proof or salary Slip For this Urgent cash loans

Basic Features of Urgent Cash loan Without Documents

- Urgent cash loan Available for Salaried and Self Employed both kind of person

- Urgent Cash loan App Gives You Small amount of loan Between 5000₹ to 50,000₹

- Tenure of Urgent Cash loan app is Very less Compare to NBFC or bank

- Interest rates little bit high from NBFC because they give loan in Emergency

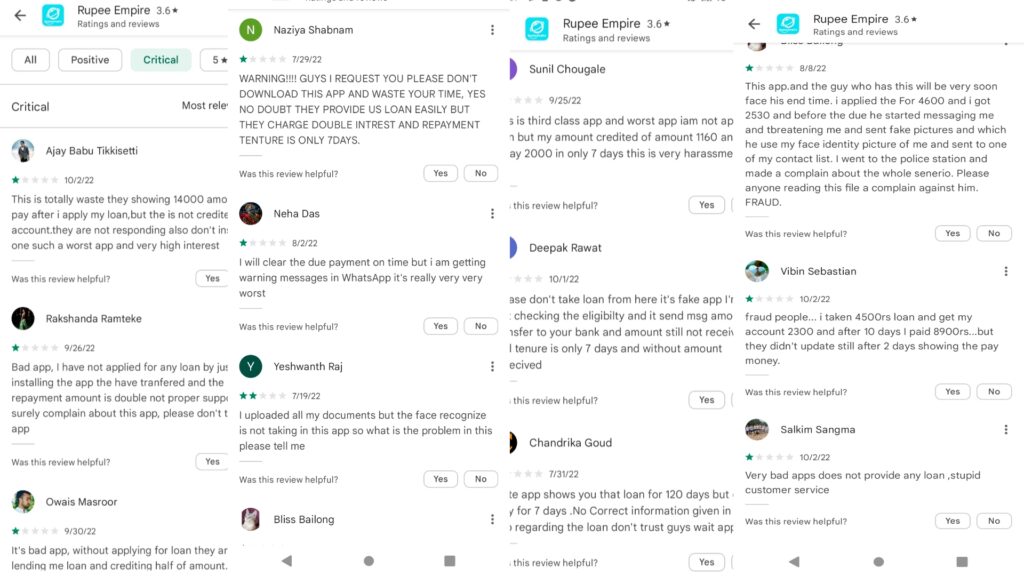

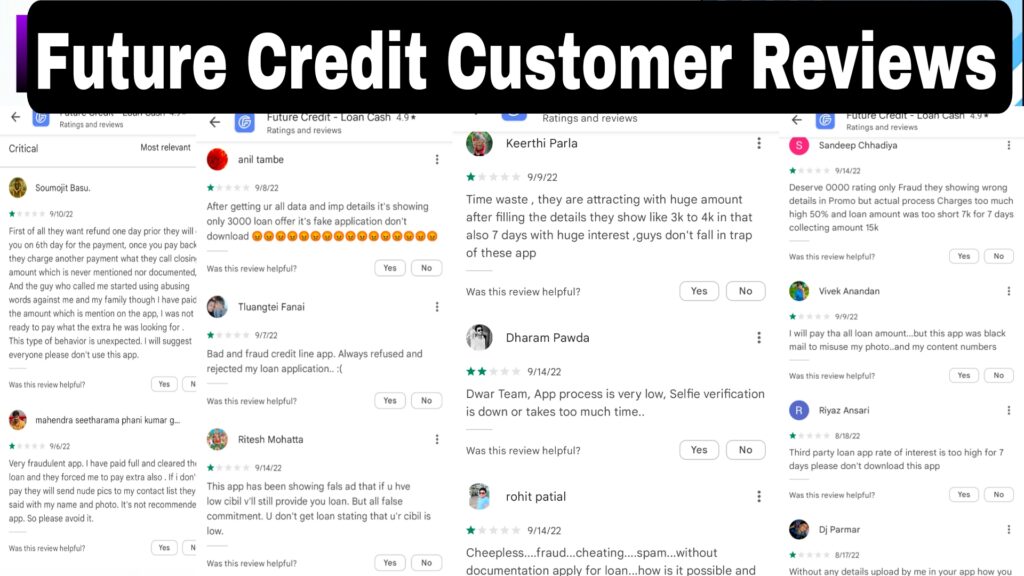

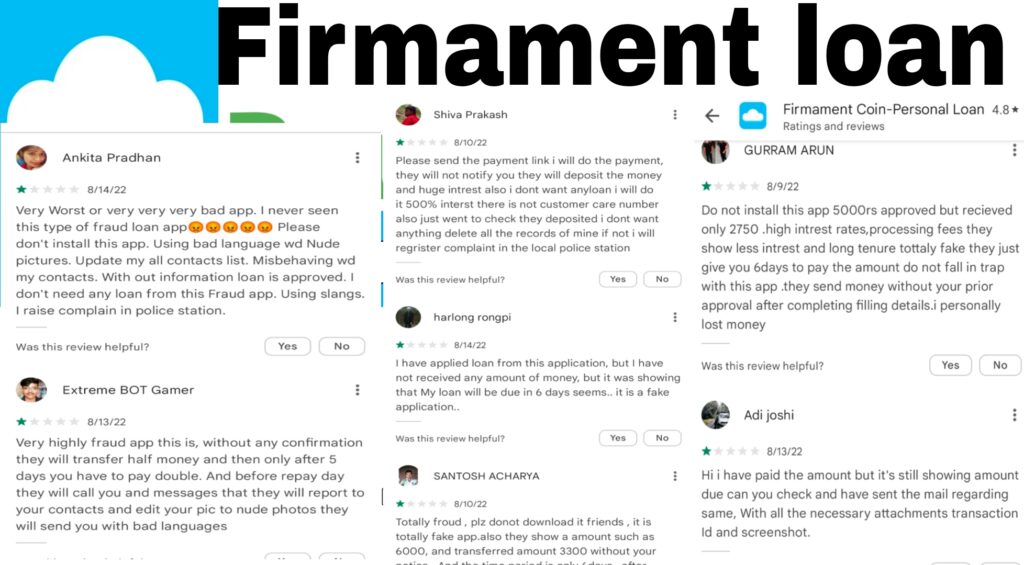

- If you Wanna take loan from Urgent cash loan apps then you should Read about these loan apps

10 Best Urgent Cash loan Without Documents

| Loan app Name | Loan amount | loan tenure | interest rates | Rating & Download |

| LoanEy loan | Upto 10,000 Urgent Cash loan | Upto 3 month | upto 36% | 1 million & 4.2 ⭐ |

| True balance loan | 5000₹ to 50,000₹ Loan | 2- 3 month | Upto 60% | 50 Million & 4.7 ⭐ |

| Rapid Rupee loan | Upto 1 lakh | 2 -12 month | Upto 30% | 1 Million |

| Banch loan app | 750₹ to 50,000 | 2-6 month | Upto 40% | 10 million & 4.6 star |

| Navi Personal loan | upto 5 lakh Rupee | 2 – 36 Months | Upto 28% | 10 million & 4.5 star |

| Kreditbee loan app | upto 2 lakh loan | 2 to 24 month | Upto 36% | 10 million & 4.6 |

| Moneyview Loan | 10k – 2 lakh | Upto 36% | 10 mllion & 4.5 ⭐ | |

| MySubhlife loan | Upto 20k For Self Employed | 2- 4 months | Upto 40% | 1 million |

| Nira loan app | Upto 1lakh | 2 – 24 month | Upto 32% | 10 mllion& 4.6 ⭐ |

| Fair money | Upto 50k urgent loan | Upto 6 months | Upto 48% | 500k+ |

How to apply Urgent Cash loan Without income Proof

- Install loan app from Play Store

- complete Your KYC documents Required

- Upload Your KYC documents

- After Filling everything wait for approval

- Ready for Selfi

- Get your loan in your bank account within 1 day

Eligibility Criteria for Small urgent loan

- You Should Have Aadhar Card for address Verification

- you Should Have pan card for CIBIL check

- You are a citizen of india